Have you ever wondered how you can make payments effortlessly with just a click? None of us have ever imagined this. But, the invention of ClickPay proved to be a game-changer in today’s modern finance world!

Have you ever wondered about the magic behind those smooth online transactions that whisk away your bills and subscriptions with just a click?

Curious minds, you’re in for a treat! In this blog, we unravel the mysteries of ClickPay, an online payment platform, and discover everything about ‘What is ClickPay?’ ‘How ClickPay works?’, and more about digital financial interactions.

From the inception of ClickPay to the nitty-gritty of its operations, this blog can be your digital finance tour guide. Imagine a world where paying your bills is as easy as sending a text – that’s the essence of ClickPay! So, let’s dive into the captivating universe of ClickPay – where simplicity meets sophistication!

What is ClickPay?

ClickPay was launched on January 18, 2022, by MobiKwik in collaboration with NPCI Bharat BillPay Ltd. (NBBL). While the idea of a single platform for bill payments is not new, MobiKwik’s ClickPay implementation, with its unique payment link feature and integration with various billers, is considered innovative.

ClickPay payment solutions simplify recurring bill payments via unique payment links billers send. Users click the link in their preferred communication channel, SMS or email, and pay directly on the secure MobiKwik platform.

ClickPay supports multiple billings, including mobile, gas, water, and electricity, and offers BNPL options. This online payment app development concept has automated the online bill payment system. Now, individuals do not have to remember bill details and due dates, saving time and offering convenience.

How Does ClickPay Works?

Online payment platforms like ClickPay make it easy and convenient for businesses to accept customer payments online. On the other hand, customers can also experience seamless and hassle-free payment. Here’s how it works:

For Customers

- Browse And Select Items: Customers can browse the ClickPay website or ClickPay app and select the items they want.

- Proceed To Checkout: Once customers have selected the items they want to purchase, they can proceed to checkout.

- Enter Their Payment Information: Next, customers will be prompted to enter their payment information, including their name, billing address, and credit card or debit card number.

- Review And Confirm Order: Finally, customers can review their order and confirm their purchase.

- Receive Confirmation: Once customers confirm their purchase, they receive a confirmation email from ClickPay online payment platform.

For Businesses

- Sign Up For An Account: Businesses can sign up for a free ClickPay account by entering their business information and contact details.

- ClickPay Integration with Website or App: ClickPay offers a variety of integration options to accept payments on your website or app hassle-free. You can choose from a simple ‘Buy Now’ button, a full-fledged shopping cart, or even a custom API integration.

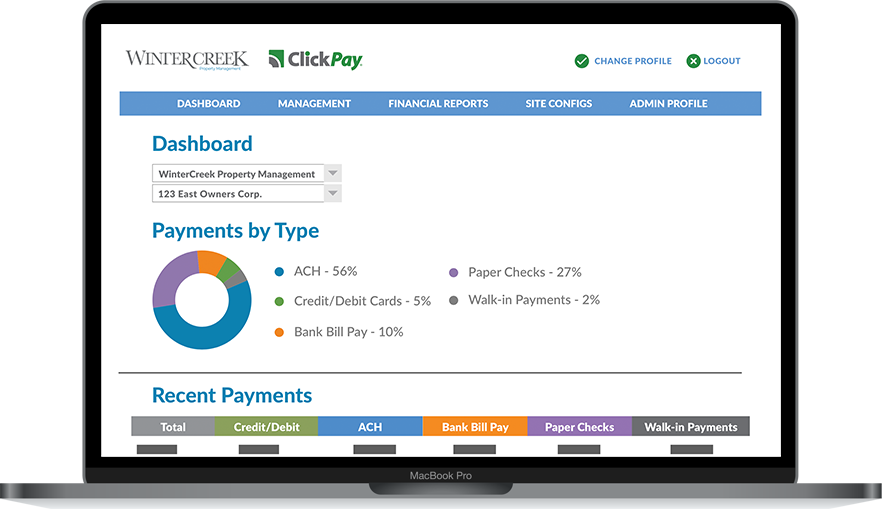

- Accept Payments: Once ClickPay is integrated with your website or app, you can accept customer payments. Customers can pay with their credit card, debit card, or ACH bank transfer.

- Manage Your Payments: ClickPay provides businesses with a secure online dashboard where they can view their transaction history, manage their account settings, and more.

So, this is how the fintech app development concept of ClickPay works and makes it easier for businesses and customers to ensure hassle-free and seamless payment experience.

Primary Uses of ClickPay Online Payment Platform

Where can I use ClickPay for? What bills can be paid using ClickPay? If these questions revolve around your mind, you must read the succeeding section.

ClickPay is a cloud-based online payment platform designed primarily for the multifamily industry, including:

- Rent Payments: This is the most common use of the ClickPay online payment solution. Residents can easily pay their rent online using various payment methods, including credit cards, debit cards, and ACH bank transfers.

- Security Deposits: ClickPay can be used to collect security deposits from residents. It is a secure and efficient way to gather deposits and protect the property owner and the resident.

- Utility Bills: Individuals use ClickPay to pay utility bills, such as water, gas, and electricity. It is one of the convenient online payment options for residents who want to pay all their bills in one place.

- Parking Fees: With ClickPay, the owners can collect parking fees from residents. Residents who want to avoid paying cash for parking can use this ClickPay option.

- Amenity Costs: Different amenity costs, including gym membership fees or pool passes, can be collected using ClickPay. It is another convenient option for residents wanting to pay for online amenities.

- Maintenance Fees: ClickPay can be used to collect maintenance fees from residents. This way, the residents can avoid cash exchange and leverage the benefits of secure HOA fee solutions.

- Application Fees: ClickPay can collect application fees from prospective residents. Landlords can use this online payment app development option for those who want to collect fees online.

Why Should Businesses Develop An Online Payment Platform Like ClickPay?

Many business owners are still unsatisfied with the concept of efficient property management with ClickPay and any other business activity. If you also wonder why I should invest in online platform development, read the following section. It will let you know why businesses develop an online payment platform like ClickPay.

Online Payment Platform Development Benefits for Businesses:

- Increased Business Sales: Online payment options like ClickPay simplify and speed up transactions, increasing customer satisfaction and potentially higher sales and revenue.

- Reduced Costs: Online payment mobile app development projects automate tasks, reduce manual data entry, and eliminate the need for paper-based processing, leading to cost reductions.

- Improved Cash Flow: Payments made with ClickPay are processed faster than traditional methods, resulting in quicker access to funds and improved cash flow.

- Enhanced Security: Reputable online payment platforms employ robust security measures to protect sensitive customer data and prevent fraud.

- Valuable Data Insights: ClickPay payment solutions collect valuable data on customer transactions and spending habits. This data can be used to gain valuable insights, improve marketing strategies, and personalize the customer experience.

- Expanded Reach: Online platforms allow businesses to reach millions of customers worldwide, expanding their reach and market potential.

- Improved Customer Experience: A seamless and secure online payment process can significantly improve customer satisfaction and loyalty.

- Flexibility and Scalability: Online platforms can quickly adapt to business growth and changing needs, offering flexibility and scalability.

Online Payment Platform Benefits for Customers:

- Convenience: Online payments made with ClickPay are quick and easy to complete, allowing customers to pay from anywhere at any time.

- Security: Reputable online payment platforms like ClickPay employ robust security measures to protect customer data, providing a hassle-free payment experience.

- Faster Checkout: ClickPay payment solutions streamline the checkout process, saving customers time and effort to a great extent.

- 24/7 Availability: Customers can make payments 24/7, regardless of business hours. On the other hand, business services are available round-the-clock for their potential customers.

- Multiple Payment Options: Customers can choose various payment methods to suit their needs and preferences.

- Increased Choice and Control: Online platforms offer a wider range of products and services, giving customers more choice and control over their purchases.

Developing an online payment platform like ClickPay offers numerous benefits for businesses and customers. Businesses can benefit from increased sales, reduced costs, improved cash flow, and valuable data insights. Customers can enjoy convenience, security, faster checkout, 24/7 availability, and multiple payment options.

It’s important to note that the decision to develop a platform like ClickPay should be based on carefully analyzing your business needs, budget, and technical capabilities.

How to Develop An Online Payment Platform Like ClickPay

Do you want to create secure HOA fee solutions like ClickPay? Don’t know where to begin with? Don’t panic and follow the step-by-step process the mobile app development company professionals suggested.

#Step 1 – Market Research & Analysis

First, begin the online payment app development process with in-depth market research and analysis. It will help you know about the top online payment platforms available. Simultaneously, knowing about your top competitors will help you discover the loopholes. Then, you can devise solutions to overcome all the loopholes in the existing online payment platform like ClickPay. So, invest more time in this process.

#Step 2 – Click App UX/UI Designing

Next comes the design of apps like ClickPay. An application’s design is the foremost element users are attracted to when they use a mobile app. So, think of a simple yet appealing design for your fintech app development project. It will help you design an amazing online payment platform like ClickPay. You can also hire graphic designers if you aren’t well-versed in the design process.

#Step 3 – Finalizing App Features & Functionalities

Features are the most crucial factors that can make or break your application’s success. So, don’t overlook this mobile app development step. Think of useful features and functionalities that can make your app like ClickPay unique than ever before. It will also help you save mobile app development costs, and ultimately, you can develop a perfect payment platform within your budget.

#Step 4 – ClickPay Payment Platform Development

The final step, i.e. to develop an app like ClickPay. You must implement all the essential information gathered in the previous mobile app development stages. You will require industrial and technical expertise to pass this step with perfection. So, if you are good at it, go for the process or hire dedicated developers from a reputed mobile app development company.

#Step 5 – App Testing & Launch

Once you complete the process to develop an app like ClickPay, conduct its in-depth testing and launch. Eliminate all the errors and bugs before you launch the application on the desired Google Play Store and App Store. And guess what? You are all set to launch your online payment platform like ClickPay.

What Are the Essential Features of ClickPay Payment Solutions?

Want to know the major features required for online payment platform development like ClickPay? Here are some important features that if added will help you ensure to deliver secure HOA fee solutions.

- Security Measures

SSL encryption during ClickPay app development ensures that all data transmitted between the user and the payment system is encrypted, protecting sensitive information.

- Multiple Payment Options

Ensure multi-payment integration, such as credit card, debit cards to cater to a wide range of users. You can also ensure integration with popular digital wallets like PayPal, Apple Pay, Google Pay, etc.

- Mobile Responsiveness

A responsive design of online payment platform development ensures a seamless payment experience across various devices, including smartphones and tablets.

- Recurring Payments

This feature increases the ability to set up and manage recurring payments for subscription-based services.

- Integration Capabilities

Add Application Programming Interface (API) for seamless integration with third-party applications, websites, or e-commerce platforms.

- Customizable Checkout

With customization features, you can allow businesses to maintain their brand identity throughout the payment process.

- User-Friendly Interface

A user-friendly interface for both businesses and customers, making it easy to navigate and manage transactions.

- Reporting and Analytics

Detailed reports on transactions, settlements, and other financial activities. Use advanced tools to analyze payment trends, customer behavior, and other relevant metrics.

- Fraud Prevention

Advanced security measures and algorithms to detect and prevent fraudulent transactions. It is one of the crucial features of fintech mobile app development.

- Customer Support

Access to customer support for assistance with technical issues, transaction disputes, and general inquiries.

How Much Does it Cost to Develop An Online Payment Platform Like ClickPay?

An essential cost to develop an app like ClickPay begins at $5,000 and might go beyond $25,000 and more depending on the type of application developed. This is just a basic online payment platform cost estimation for simple applications. If you want to create an advanced application, you must pay high mobile app development costs. Besides this, some major factors are deciding the cost of ClickPay payment solutions. Have a look at some cost-affecting factors –

- App features and functionalities

- Tech stacks

- App complexity

- Development team location

- UX/UI design

- Developer’s expertise

- Type of application

Looking for Online Payment Platform Development Services? Let’s Connect!

The quest for reliable and efficient online payment platform development services has never been more critical in our rapidly advancing digital era. As businesses strive to stay competitive and meet the evolving needs of their customers, a seamless and secure payment system like ClickPay is a fundamental requirement.

Connecting with the right mobile app development company can make all the difference in streamlining business operations, enhancing user experience, and ensuring trust and customer satisfaction.

Whether you are a Startup looking to establish a robust payment infrastructure or an established enterprise seeking to upgrade your existing system, TechnoYuga can be your saviour.

With a team of dedicated developers, creative designers, and experienced quality analysts, we can deliver outstanding ClickPay payment solutions to you. Feel free to share your project requirements with us.