Are you Interested to build an app like Cleo? While it may present challenges, thorough research and understanding can pave the way for the development of user-friendly and robust platforms or an app like Cleo.

The financial app market, valued at USD 1.23 billion in 2022, exhibits promising growth potential. Projections suggest a climb to USD 1.435342 billion in 2023 and a substantial leap to USD 2.82 billion by 2030, with an anticipated compound annual growth rate (CAGR) of 12.12% during this period. This upward trend emphasizes the escalating adoption and demand for personal finance app development.

In this blog post, we will define the essential steps and considerations to build an app like Cleo. From leveraging artificial intelligence algorithms to incorporating an intuitive user interface, every aspect is meticulously addressed. Let’s start off this journey together and discuss the steps for Cleo app development.

About Cleo App

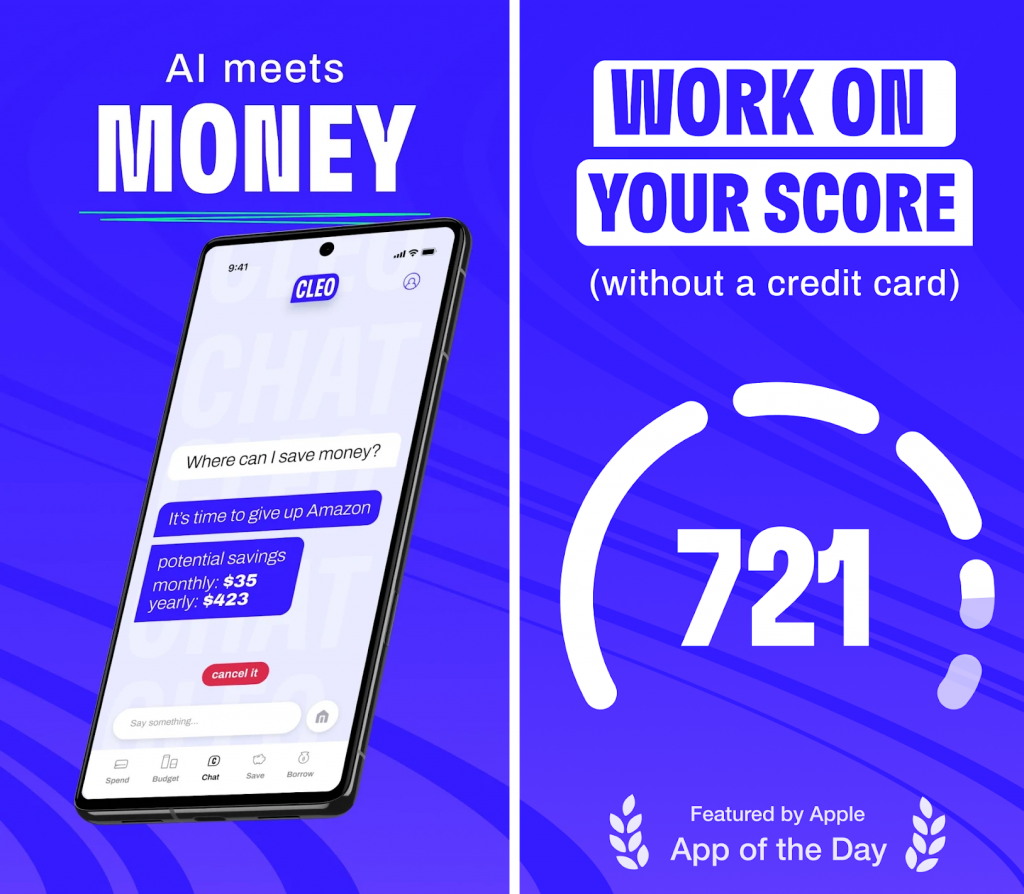

Cleo, an AI-driven budgeting application, has rapidly gained popularity for simplifying personal finance management, earning it the nickname “Siri of personal finance.” This digital assistant aids users in organizing and controlling their finances, facilitating increased savings and reduced expenses.

Apps like Cleo utilize AI technology to provide engaging features aimed at enhancing user savings. Cleo seamlessly integrates with user accounts to collect and analyze spending data, enabling it to offer tailored advice on cost-cutting strategies while maintaining interactive engagement with users. Additionally, Cleo offers a digital wallet feature for convenient storage and access to funds.

For businesses interested to build an app like Cleo, collaborating with the top mobile app development company can be a prudent choice.

Why to Invest in Cleo App Development?

Investing in instant cash apps like Cleo app development presents a prosperous opportunity, potentially leading to a multimillion-dollar business venture. These apps offer a abundance of essential features, empowering users to streamline financial management effectively:

- Efficient tools for managing personal finances.

- Expert insights aiding in saving and investing wisely.

- Budgeting features for expense tracking and goal setting.

- Access to financial data anytime, anywhere via a user-friendly mobile app.

- Personalized financial insights through AI and machine learning analysis.

- Organization through expense categorization and bill reminders.

- Robust data security safeguarding user accounts and financial details.

- Educational resources enhancing financial literacy.

- Future financial planning support for savings, investments, and long-term goals.

- Real-time updates on financial health.

For comprehensive guidance, consulting with experts from android app development company can provide valuable insights into this lucrative field.

How to Build an App like Cleo?

To build an app like Cleo following key steps are involved:

Market Research and Project Scope Definition:

-

- Conduct thorough market research to understand the demand, competition, and target audience for cash advance apps.

- Define the scope of your project by setting clear goals, prioritizing features, and identifying what sets you apart from competitor apps like Cleo.

Technology Stack Selection and User Interface Design:

-

- Choose the appropriate technology stack based on target platforms and development frameworks.

- Design a user-friendly interface that enhances user experience and engagement, ensuring easy accessibility to important features.

- Always look for a reputable fintech app development company or you can hire dedicated developers who can develop a more interactive and user-friendly interface.

Backend Development and Payment System Integration:

- Develop a secure, scalable backend including database and API management.

- Integrate payment systems like PayPal or Venmo to facilitate seamless user transactions and ensure smooth funds management processes.

Security Measures Implementation and App Testing:

-

- Implement robust security measures such as encryption, SSL, and 2FA to protect user data and prevent unauthorized access.

- Conduct thorough testing and debugging to ensure the app runs smoothly and is free from bugs, employing both user testing and automated testing technologies.

- Always consult a reputable ewallet app development company for a plan for regular audits for identification of potential security risks and address them accordingly.

App Launch and Performance Monitoring:

-

- Launch the app on Apple App Store or Google Play Store after rigorous testing and debugging.

- Monitor the app’s performance closely, gather user feedback, and make necessary refinements to enhance functionality and user experience over time.

App Marketing and Promotion:

- Employ effective digital marketing strategies such as social media advertising, SEO, and influencer marketing to reach a wider audience and drive downloads.

- Partner with financial institutions or organizations and offer referral bonuses or special promotions to increase brand recognition and user acquisition through word of mouth.

By following these steps with great care, you can build an app like Cleo, providing users with a seamless and efficient financial management experience.

How To Use Fintech Apps Effectively?

When investing in a Cleo app development company, it’s essential to emphasize responsible usage. Instant cash apps provide short-term financial aid, so it’s vital to set a loan request amount wisely, avoiding excessive debt and minimizing interest costs. Borrow only when necessary, not beforehand.

Create a clear repayment plan to avoid missed payments, which can lead to credit score drops and additional expenses like rollovers and late fees. Avoid upfront payments, as they could signal potential scams by lenders. Seek guidance from a top mobile app development company to plan effectively and ensure responsible usage of the app like Cleo.

Here are some of the key pointers that you can consider –

1. Intuitive User Interface and Usability

- Fintech apps are primarily used on mobile devices, so ensure your app has an easy-to-navigate interface.

- Clear instructions, well-placed buttons, and logical layouts enhance usability.

- Users should be able to perform tasks without confusion or frustration.

2. Security Features

- Prioritize customer data protection.

- Implement password protection, data encryption, and fraud prevention measures.

- Users trust fintech apps with sensitive information; reassure them of its safety.

3. Integration with Other Financial Services

- Design your app to work seamlessly with other financial apps and services.

- Enable easy money transfers between accounts and streamline user experience.

4. Customer Support

- Even the best apps encounter glitches. Have a robust customer support system in place.

- Promptly address user issues to maintain trust and satisfaction.

Start Your Personal Finance App Development Journey with TechnoYuga

Once you’ve identified the essential steps to build an app like Cleo, the next step is embarking on personal finance app development. Crafting an app like app can pose challenges due to market competition and security risks. However, partnering with a reputable and seasoned on demand app development company, such as TechnoYuga, can streamline the process.

As an award-winning software and mobile app development company, we specialize in fintech application development. Our expertise ensures the personal finance app development has all the relevant features and exceptional user experiences, tailored to your specific money management needs. Let us assist you in transforming your Cleo app development into reality.