Key Takeaways:

- The modern financial services cannot be imagined without Fintech Software Development that allows developing secure, scalable, and compliant platforms.

- The partnership with a reputed Fintech Software Development Company will ensure a faster implementation, regulatory adherence, and effective technology implementation.

- Fintech modules can be customized to strengthen payments, lending, trading and wealth management, risk management and streamline operations and make them more user friendly.

- The future of digital financial platforms lies in the up-and-coming trends of AI in fintech, blockchain, embedded financial, and open banking.

- With strategic investment in digital banking software and smart fintech platforms, businesses are in a growth, innovation and competitive advantage position in a rapidly changing market.

Introduction

The global financial environment is experiencing an enormous digital change, and the centre of this change is the Fintech Software Development. Undoubtedly, technology is transforming the functionality of financial services, whether it comes to instant payments, AI-driven trading and automated compliance. Customers today are demanding rapid service, transparency and smooth digital experiences, and this has compelled the banks and NBFCs and new-age fintech startups to modernise their legacy systems and adopt new-age digital experiences.

Currently, financial institutions are no longer completely based on products, but are based on user experience and security, as well as their capability to adapt quickly. This is where it would be necessary to collaborate with a trustworthy Fintech Software Development Company. These companies are also assisting in creating safe, scalable and regulation-ready systems through which businesses can innovate more rapidly and remain in line with stringent international standards.

With digital finance becoming a new reality, fintech software is making it possible to create the next generation of financial ecosystems, in which payments, lending, investments, and compliance run smoothly in real time. For all of you out there, here we will help you to know things in alignment with Fintech Software development and how it is revolutionising the era. Keep on reading to know about everything in detail!

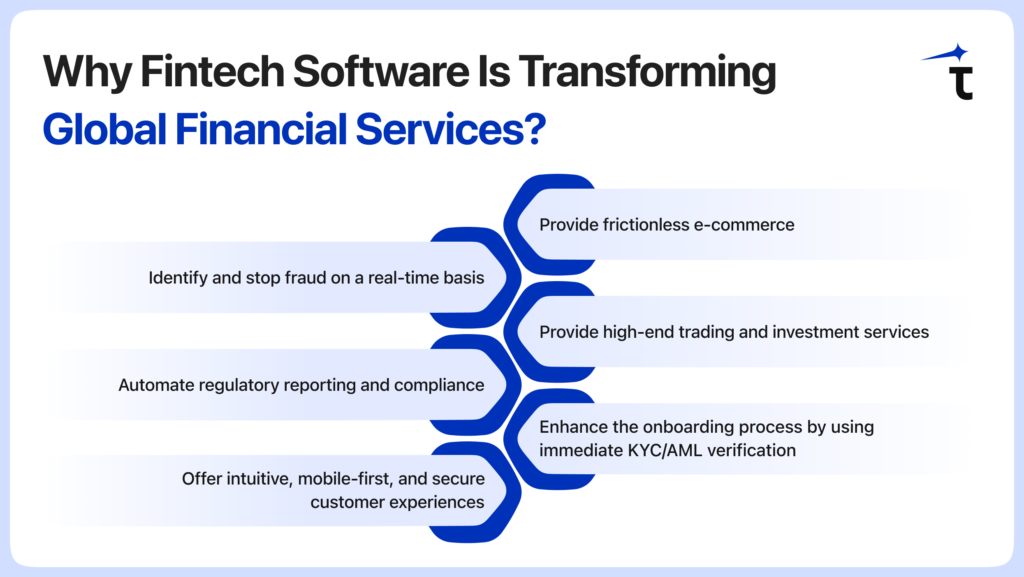

Why Fintech Software Is Transforming Global Financial Services?

The fintech innovation is not only enhancing the traditional financial processes; it is entirely transforming them. The use of advanced technologies such as AI, blockchain, cloud computing, and API-based architectures are also leading to a faster, safer, and more personal financial service.

Financial institutions are adopting digital platforms to:

- Provide frictionless e-commerce

- Identify and stop fraud on a real-time basis

- Provide high-end trading and investment services

- Automate regulatory reporting and compliance

- Enhance the onboarding process by using immediate KYC/AML verification

- Offer intuitive, mobile-first, and secure customer experiences

Through Fintech, there is a democratisation of the provision of financial services and digital banking, wealth management, and trading have become accessible to millions of people. Both startups and businesses are now using solutions customised to their needs by seasoned Fintech Software Development Companies to launch applications, scale infrastructure, and remain on top of an ever-changing market.

The change is no longer a choice, but a business and a competitive need. Thankfully, the businesses are also ready to adapt to this change and stay ahead with all the trends going on.

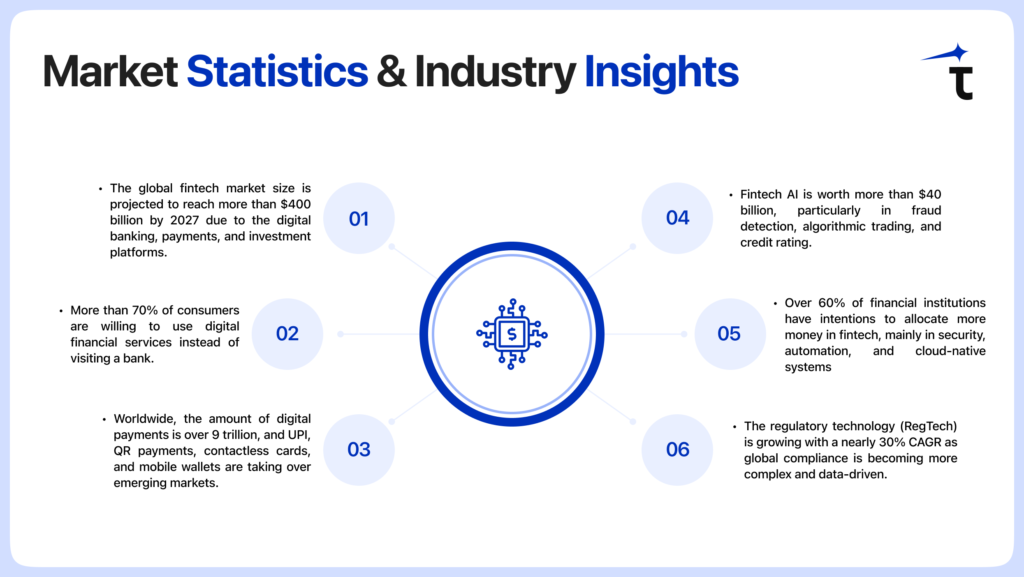

Market Statistics & Industry Insights

Fintech has become one of the most disruptive as well as fast-scaling sectors across the globe, and this has led to the adoption of fintech software development more. According to recent market research:

- The global fintech market size is projected to reach more than $400 billion by 2027 due to the digital banking, payments, and investment platforms.

- More than 70% of consumers are willing to use digital financial services instead of visiting a bank.

- Worldwide, the amount of digital payments is over 9 trillion, and UPI, QR payments, contactless cards, and mobile wallets are taking over emerging markets.

- Fintech AI is worth more than $40 billion, particularly in fraud detection, algorithmic trading, and credit rating.

- Over 60% of financial institutions have intentions to allocate more money in fintech, mainly in security, automation, and cloud-native systems.

- The regulatory technology (RegTech) is growing with a nearly 30% CAGR as global compliance is becoming more complex and data-driven.

These figures underscore the reason why the need for Fintech Software Development is increasing day by day and why companies in the banking, payments, lending, and trading sectors may be seeking the services of skilled development partners to remain safe and profitable.

Benefits of Fintech Software Development

Fintech is no longer an optional innovation but a necessity for being a modern financial organisation. With digital-first experiences becoming the worldwide standard, companies in the banking, lending, payments and investment sectors rely on sophisticated Fintech Software Development to increase efficiency, security as well and customer satisfaction.

For Banks, NBFCs & Fintech Enterprises

Faster and secure digital payments:

The banks and other financial institutions should have systems that can handle millions of transactions per second, and yet be as secure as possible, and guard against fraud. Fintech software enables companies to access real-time transaction processing, advanced encryption, tokenisation and an automated settlement system. This guarantees users rapid, secure, and smooth payment in channels.

Automated risk management & fraud prevention:

Financial risk has also changed with the growth in digital transactions. AI-based risk engines understand user behaviour, identify anomalies, rate credit risk and thwart fraud with high precision. Such automated systems will minimise the role of human intervention, minimise losses of money, and ensure trust in digital platforms.

High-speed trading & investment automation

In order to compete, trading companies use high-frequency algorithms, real-time price feeds, and fast execution engines. Fintech Software development helps with innovation and allows platforms to be low-latency, predictive analytics and automated strategy-powered to assist traders and investors in making smarter, faster decisions in dynamic markets.

Regulatory-ready financial operations:

Banks and NBFCs are subjected to strict regulations, including the requirements of KYC, AML, PCI-DSS, GDPR, RBI guidelines, FATF norms and others that are also necessary to follow during fintech software development. Fintech software automation can improve compliance processes, create audit-ready reports, handle data securely, and update regulatory requirements to minimise operational risk and avoid fines.

Improved customer onboarding (KYC/AML):

Onboarding and identity verification are vital to financial services. KYC, video verification, document scanning, and automated AML monitoring processes are based on AI and are faster and more accurate. The fintech software is built in such a way that customers can access faster, and the institutions minimized errors, bottlenecks and operation delays.

For Developers, Teams & Operations

Streamlined workflows with automation

Automation eradicates redundant work, shortens the development loops and improves the quality of code. CI/CD tools, automated test and monitoring can assist the teams to provide updates more reliably and quickly.

API-driven integrations across financial systems

One cannot deny that the Fintech systems rely on a variety of integrations, which include, but are not limited to, payments, KYC services, trading gateways, risk engines, CRM systems, etc. The API-first approach guarantees that there is a seamless interaction between the systems, minimises downtimes, and makes future upgrades easier.

Real-time data insights for performance improvement

Analytics engines, operational dashboards, and real-time monitoring solutions that are a part of fintech software development assist teams to monitor performance, identify errors in real-time and optimise systems using detailed insights. The outcome of this is enhanced system stability, quicker debugging and enhanced user experiences.

Compliance-ready development processes

The developers will be required to observe high security and documentation measures. Doing fintech software development involves understanding encryption guidelines, safe coding techniques, privacy, and audit trail-making sure that systems are fully up-to-date.

For Customers & End Users

Frictionless digital transactions

The customers want payments, transfers, and other financial operations to be fast and seamless. Fintech software not only increases speed but also minimises failures and provides smooth operation even at peak loads.

Personalized financial insights

AI-driven recommendations, spending analytics, credit scoring, and customised investment suggestions help customers make more informed financial decisions. This level of personalisation builds trust and long-term loyalty. The developers during fintech software development pay special attention to all this for a better output.

Instant verification, approvals & secure access

Automated KYC, biometric authentication and real-time decision engines facilitate easier approvals in loans, account openings and decision-making. This enhances satisfaction among customers and decreases abandonment.

Transparent, reliable financial experiences

When a fintech software development is considered, transparency has turned out to be one of the biggest concerns. Undoubtedly, transparency, user-friendly interface/experience, safety, and reliable service provide a reliable financial space. The users are able to obtain the complete transaction records, notifications, and insights without complexities.

Types of Fintech Software Solutions

Presently, the financial services are based on various digital systems that have been developed based on modern Fintech Software Development. These solutions deal with various levels of financial work-pays and trading, compliance, lending, insurance and more. All types are playing a significant role in facilitating innovation, security and speedy digital transactions in world markets.

By Function

Digital Payments & Wallets (UPI, cards, QR, peer-to-peer)

Undoubtedly, digital payment systems have become the foundation of modern financial activities. These platforms facilitate UPI payments, card processing, transactions using QR and mobile wallets, as well as peer-to-peer transfers. These activities also demand sophisticated back-end platforms to route transactions, encrypt them, settle them, detect fraud, and monitor them in real-time. The Fintech Software Development Company has to be robust to ensure that these solutions can be used with enormous levels of transactions in the security of these solutions.

Banking & Core Banking Systems (CBS modernisation)

The traditional core banking systems are unable to keep up with the digital requirements. The modern CBS platforms are based on the architecture of microservices, cloud-native infrastructure, and API-driven workflow to be faster, secure, and flexible. Account management, deposits, loan cycles, and ATM/branch systems are driven by these systems in real time with precision.

Trading & Investment Platforms (stocks, crypto, forex)

Trading has become one of those financial activities that has grown tremendously in the past years. To keep up with the same demand, trading systems require the use of high-frequency execution engines, real-time price feeds, algorithmic trading, and analytics. Regardless of whether it is stock markets, crypto exchanges, or forex trading, the fintech software development opens avenues to such platforms that allow access to an intuitive dashboard, high-performance, and secure transactions on both retail and institutional levels.

Compliance & RegTech Solutions (AML, KYC, reporting)

RegTech solutions streamline regulatory procedures, lower the compliance expenses, and ensure that financial institutions comply with all the local and international requirements. Primary characteristics are automated KYC check, AML, suspicious activity reports (SAR) and documentation that is auditable. The modern fintech systems have the capability to be constantly updated with regulatory changes.

Lending & Credit Scoring Platforms

Most lending activities or processes are handled through digital lending platforms as far as loan applications, underwriting, disbursals and collections are concerned. The AI-based credit scoring systems consider financial behaviour and alternative data, and repayment patterns to offer correct risk estimation. These channels facilitate bank, NBFCs and fintech lending.

InsurTech Solutions

The insurance companies apply fintech to make claims digital, underwrite automatically, identify fraud, and tailor policies. InsurTech platforms automate the insurance lifecycle, starting with customer onboarding, premium tracking and risk analysis.

By Industry

Banking & Financial Services

Fintech solutions are used in payments, mobile banking, KYC automation, fraud prevention, the digital onboarding process, compliance and the modernisation of core banking by banks. Such systems will guarantee efficiency in operations and a better customer experience. This is the major reason that these days fintech software development market is booming.

NBFCs & Lending Institutions

To save time and minimise risk, NBFCs rely on digital lending applications, automated underwriting systems, credit score systems, and loan management systems.

Insurance Sector

Insurers are using InsurTech platforms to automate their claims and policy management, detect fraud, onboard customers and provide personalised coverage advice.

Capital Markets & Broking Firms

Retail and institutional traders need real-time market data, execution engines, trading algorithms, investment analytics and secure transaction systems on brokerage platforms.

Crypto & Web3 Exchanges

Cryptocurrency exchanges require blockchain solutions, wallet applications, KYC/AML authentication, secure custody, and decentralized trading infrastructure. Fintech has been a factor in the provision of speed and security in managing digital assets.

Retail & E-commerce Payments

Online merchants are also dependent on the secured payment gateways, point-of-sale systems, UPI connectors, subscription billing applications and fraud detection layers to facilitate large volumes of online payments.

Travel, Healthcare & Education Payments

Sector-specific payment solutions help them make recurring payments, automate invoices, have instant settlements and be in compliance with industry standards and tax requirements.

Enterprise Finance & ERP Systems

The integrated financial management systems, automation of accounting, digital invoicing, expense tracking, and treasury management systems are beneficial to large enterprises, simplifying the work of internal operators and increasing financial accuracy.

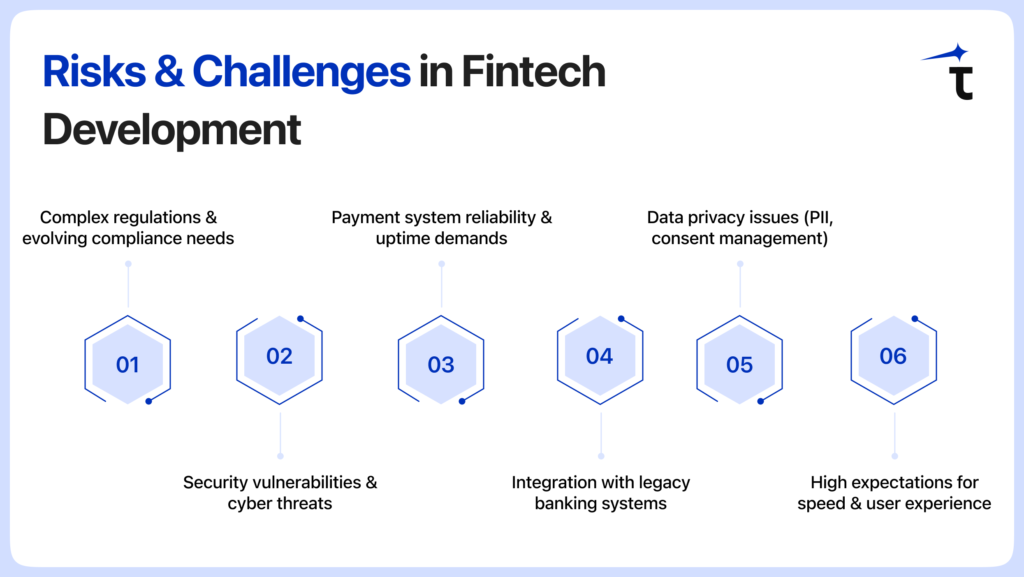

Risks & Challenges in Fintech Development

There are complex challenges that are associated with building high-performance fintech software development solutions. With all businesses adopting financial software development for digital transformation, the challenge that they have to overcome is regulatory, technical and security risks and more. Some other ones to note down include:

Complex regulations & evolving compliance needs

Fintech applications are highly regulated, and it is a prerequisite that they comply with KYC, AML, PCI-DSS, RBI regulations, RegTech, and data governance frameworks. In the case of teams that offer fintech software development services, there are new regulatory changes that produce constantly shifting targets that need to be met adequately without interfering with the operations of a system.

Security vulnerabilities & cyber threats

The core of fintech software development is “SECURITY”. From encryption failures to API exploits, phishing attacks, and fraud loopholes, every digital banking platform must deliver enterprise-grade protection. The current AI in the fintech sector assists in identifying anomalies, yet threats are changing rapidly- this is where zero-trust architecture becomes significant.

Payment system reliability & uptime demands

Customers want the high uptime of 99.99% whether it is digital banking software, UPI payments, wallets or card systems. Millions of transactions can be affected even by several seconds of downtime. High availability of the distributed systems is one of the most challenging engineering tasks of any fintech software development firm in India or worldwide.

Integration with legacy banking systems

Banks and NBFCs continue to be dependent on decades-old internal infrastructure. Modernisation of these legacy systems can be slow and expensive, and in many cases, requires the creation of custom connectors, API layers, and middleware to integrate modern mobile banking app development with these older systems.

Data privacy issues (PII, consent management)

Fintech systems deal with sensitive PII, financial background, credit reports and behavioural analytics. It is very important to adhere to GDPR, DPDP India Bill, and international laws on privacy. Any mistake can have a catastrophic effect on the trust in digital finance.

High expectations for speed & user experience

Customers desire lightning-fast interfaces, real-time insight, personalised dashboards, streamlined KYC workflows, and instant approvals. This drives fintech software development teams to develop highly optimised, scalable designs on the wealth, insur, reg, lending, and investment platforms.

How to Build Fintech Software — Step-by-Step Process

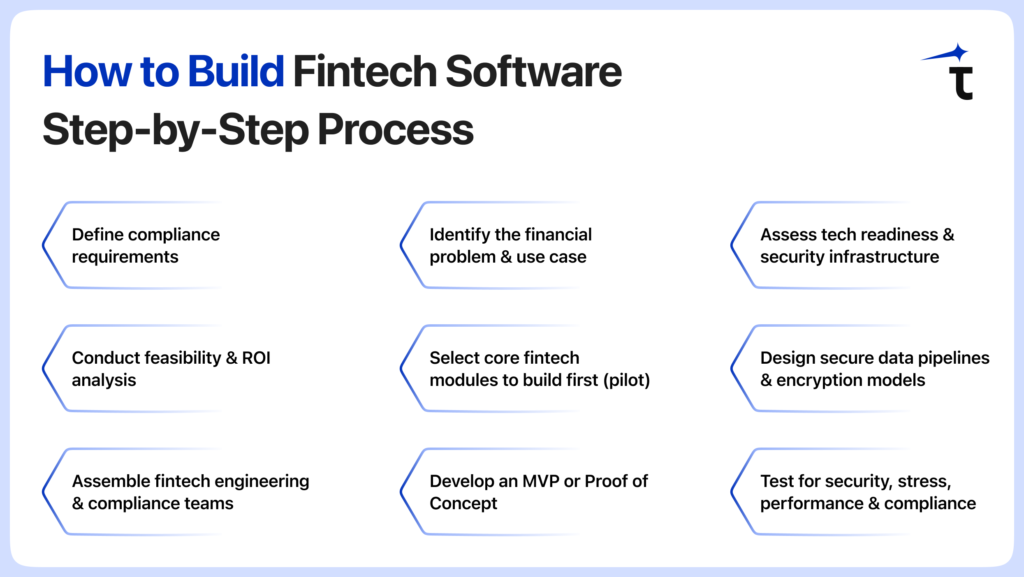

Developing the open, scalable and secure fintech product requires a systematic approach. You can get in touch with a startup developing customised fintech solutions or an enterprise collaborating with a Fintech Software Development Company, but the bottom line is that a clear development roadmap will allow you to launch faster and with less risk. The fintech software creation process is broken down into stages, beginning with the idea and ending with deployment, as shown below.

Identify the financial problem & use case:

The initial step is to establish the fundamental issue that your fintech product will address. Be it digital payments, lending automation, wealth management, fraud detection, mobile banking, or RegTech. A better understanding of the issue will be helpful in facilitating the attainment of business objectives through the appropriate fintech software development services and technologies.

Define compliance requirements (KYC, AML, PCI-DSS):

Regulatory compliance cannot be ignored, and any fintech project has to begin with regulatory mapping. Regulatory frameworks like KYC, AML, PCI-DSS, SOC2, ISO 27001, and local requirements, such as those by the RBI, or any other national bank of the particular country need to be recorded at an early stage. An experienced financial software development company would guarantee compliance-first design so as to prevent rework in the future.

Assess tech readiness & security infrastructure:

Review your existing systems, data protection functionality, access controls, and encryption standards, and security posture before writing a single line of code. Current fintech software development adheres to a zero-trust philosophy of protecting sensitive financial information.

Conduct feasibility & ROI analysis:

A feasibility study assists in authenticating the potential of the market, technical intricacy, and compatibility with the regulatory framework, as well as the ROI estimates. To most businesses, collaboration with an experienced Fintech Software Development Company would hasten this process with tried and tested structures and case studies.

Select core fintech modules to build first (pilot):

Select the bare minimum modules that include onboarding, payments, wallet, KYC engine, loan evaluation, or dashboard. This provides a framework to scale, thus enabling you to test the response of the user and, when all is well, scale to full-scale digital banking software or investment systems.

Assemble fintech engineering & compliance teams:

An experienced fintech software development team comprises the backend developers, mobile developers, cloud architects, DevOps engineers, AI specialists, QA testers and compliance experts. In case in-house recruitment is problematic, recruiting an outsourcing company in India that specialises in fintech software development would help to save a lot of money and time.

Choose technology stack (cloud, microservices, blockchain, AI):

Modern fintech platforms rely on:

- Cloud-native infrastructure (AWS, Azure, GCP)

- Microservices for scalability

- Blockchain for secure transactions

- AI in fintech for fraud detection, risk scoring, and personalization

- API-first architectures for seamless integrations

The tech stack should support automation, high availability, and rapid scaling.

Design secure data pipelines & encryption models:

As PII and financial data are processed with the help of fintech apps, encryption, tokenisation, secure data storage, and real-time monitoring become a necessity. This is so because a professional financial software development company establishes effective data governance structures early in their life cycle.

Develop an MVP or Proof of Concept:

Begin small with an MVP that is oriented on core value delivery. This enables the rapid validation, early feedback and makes it cost-efficient in development. The early MVPs may consist of logins, KYC, payments, dashboards, and alerts.

Test for security, stress, performance & compliance:

To be reliable, fintech systems are rigorously tested: penetration testing, API load testing, performance benchmarking, and compliance audits. Testing plays a key role in gaining user confidence and complying with regulatory standards.

Integrate with banks, PSPs, or third-party systems:

Banks, NBFCs, PSPs, payment gateways, credit bureaus, UPI rails, AML, and analytics are important integrations that can make operations successful. The majority of fintech development services and middleware are interoperable with the help of secure APIs.

Launch, monitor, and optimise for scale:

Once deployed, it is necessary to continuously monitor to see the success of the transactions, latency, security alerts, user journeys, fraud attempts, and system uptime. Ongoing optimisation guarantees the development of your product to its fullest potential of being a highly scalable custom fintech solution serving millions of users.

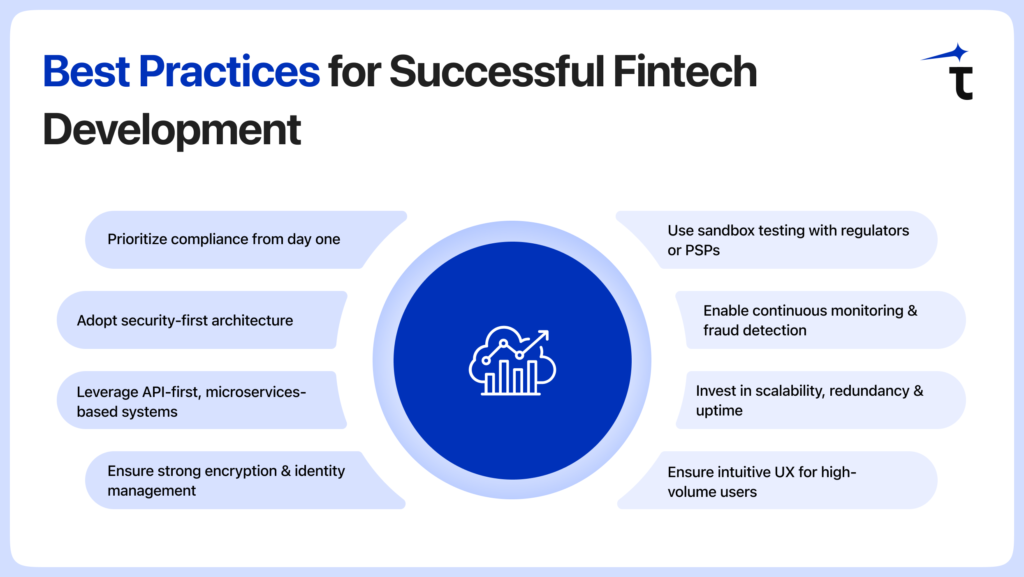

Best Practices for Successful Fintech Development

Building a high-performance fintech product requires strict compliance with security, scalability, and user experience. Whether you are getting in touch with an in-house team or collaborating with an experienced Fintech Software Development Company, it is best to adhere to these best practices to get a seamless flow and stable products in the long run.

Prioritize compliance from day one:

Placing compliance on the back burner in fintech software development is impossible. All functions onboarding, payments, lending, KYC, AML, UPI, and card processing must correspond to the standards of regulations. Being proactive prevents you from the redesign cost, and you have a product that is auditable in both the global and local systems.

Adopt security-first architecture:

The fintech software development company pay special attention to security. The modern systems are based on zero-trust architecture, multi-layered firewalls, secure API gateways and threat detection. This is helpful in securing customer information and enhancing the reliability of the platform.

Leverage API-first, microservices-based systems:

Fintech platforms operate best when built using modular, API-driven microservices. This solution provides accelerated updates, effortless third-party implementation and smooth scaling. It has become the modern standard of custom fintech solutions and digital banking products in the industry.

Ensure strong encryption & identity management:

Multi-factor authentication, biometric verification, and secure identity access management may be used to comply and ensure user trust through strong encryption of the data at rest and in transit. Any leading fintech software development firm focuses on mature IAM at all touchpoints.

Use sandbox testing with regulators or PSPs:

Prior to live fintech software development deployment, fintech apps have to be tested on controlled environments. Sandbox testing banks, regulators, PSPs, or payment gateways minimises the risk and ensures that all interactions, flows, and API behaviour follow the real-life conditions.

Enable continuous monitoring & fraud detection:

Real-time analytics powered by AI in fintech helps identify suspicious transactions, anomalies, and fraud patterns instantly. Continuous monitoring is essential for platforms managing high transaction volumes, especially in payments, lending, and wealth management.

Invest in scalability, redundancy & uptime:

Fintech systems should be able to operate 99.99% to guarantee that they are not interrupted. Auto-scaling, redundancy planning, distributed nodes, and cloud-native arrangements will assist your platform to meet peak loads which is essential to all Fintech Software Development Companies providing enterprise-level solutions.

Ensure intuitive UX for high-volume users:

Customer retention is determined by the user experience. Clean dashboards, transparent flow of transactions, immediate approvals, and rapid onboarding enhance the connection between digital banking, wallets, lending, and investment applications. Any successful service of fintech development is based on a smooth UX.

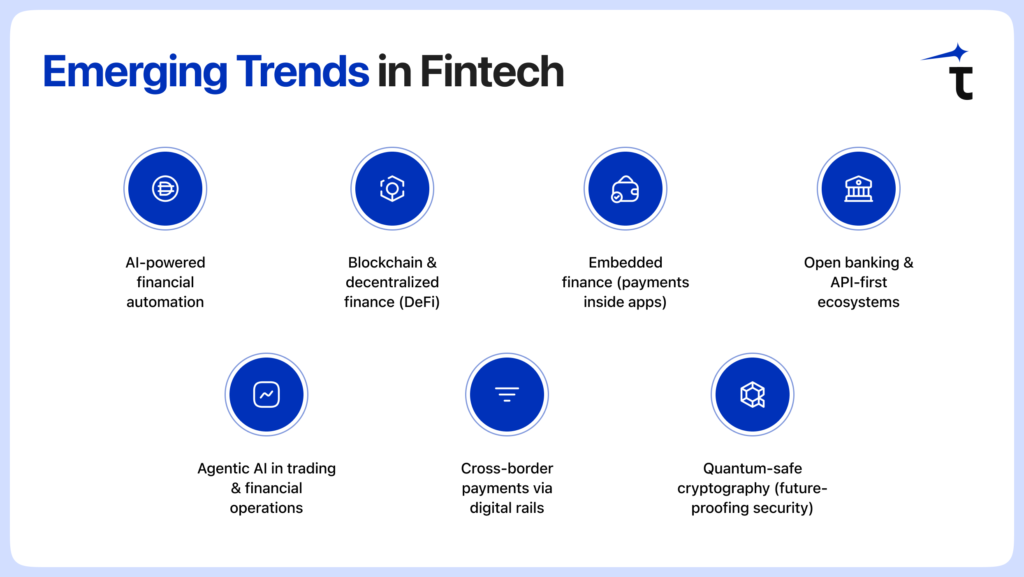

Emerging Trends in Fintech

The global financial environment is changing very fast, with the new technological ways transforming the payments sector, banking, insurance, lending, and investment systems. Current Fintech Software Development incorporates intelligent automation, decentralised finance, and a high-level security framework with the purpose of creating financial platforms of the future. All the prominent Fintech Software Development Companies are utilising such trends to assist institutions in developing quicker and work more safely.

AI-powered financial automation

AI is transforming the digital finance sector, including automated loan applications and personalised wealth management and risk prediction. Fintech platforms have intelligent agents, ML models, and real-time behavioural analytics to decrease fraud, fasten decisions, and open hyper-personalised user experiences.

Blockchain & decentralized finance (DeFi)

The use of DeFi, smart contracts, tokenized assets, and blockchain-ledgers is changing the manner in which transactions are authenticated and confirmed. Such decentralised systems minimise intermediaries, enhance transparency, and allow programmable financial processes of payment, lending and trading.

Embedded finance (payments inside apps)

Embedded payments, lending, wallets, and insurance are now included in non-financial apps, such as retail, travel, logistics, healthcare, e-commerce. This trend generates additional sources of revenue and facilities more accessibility through the provision of financial services into daily systems.

Open banking & API-first ecosystems

The laws of open banking compel banks to exchange secure data using APIs. Fintech applications today take the API first approach to connect banks, PSPs, third party applications and service providers in a seamless manner – unlocking individually personalized financial experiences.

Agentic AI in trading & financial operations

Agentic AI models are able to perform tasks on their own, trading strategies, checking market volatility, doing reconciliations or customer workflows. It is becoming a fundamental differentiator in the next-gen fintech solutions.

Cross-border payments via digital rails

Quick worldwide payments through digital rails, blockchain remittances, and payment interoperability programs funded by the G20 are assisting in the faster, cheaper, and more secure cross-border payments- an invaluable feature of global digital finance.

Quantum-safe cryptography (future-proofing security)

As quantum computing expands, the fintech platforms will need to transition to quantum-resistant encryption algorithms. The fintech software development services are already forward-thinking and are implementing quantum-safe protocols to secure long-term financial data.

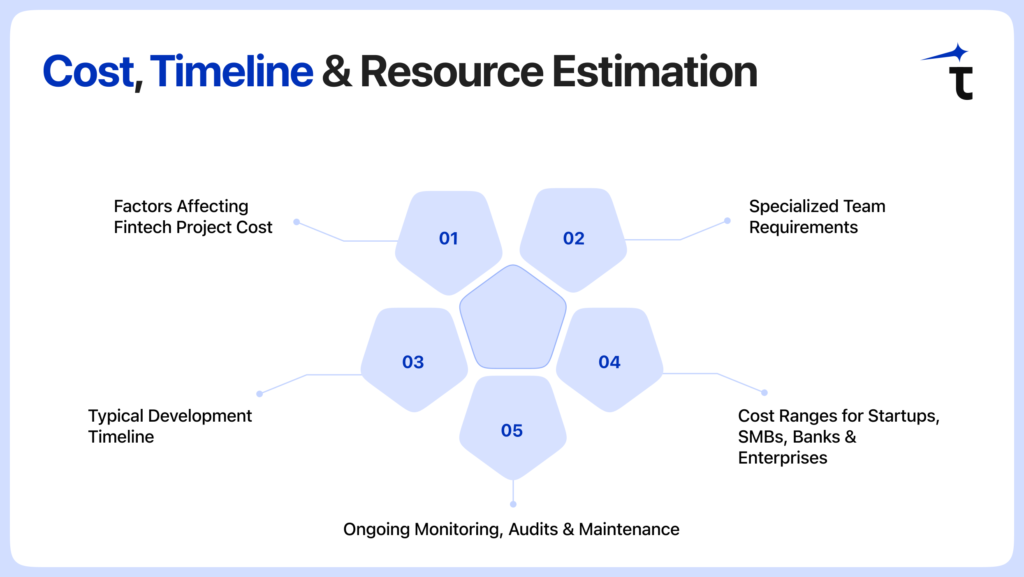

Cost, Timeline & Resource Estimation

Building a fintech platform requires deep technical expertise, strict compliance alignment, and a well-defined development roadmap. The cost varies based on the platform type, security requirements, third-party integrations, and whether you partner with an experienced Fintech Software Development Company.

Factors Affecting Fintech Project Cost

Fintech systems require secure architecture, advanced encryption, KYC/AML automation, audit trails, and multiple integrations—such as banks, PSPs, credit bureaus, wallets, or trading data providers. Complexity in compliance and performance requirements significantly influences cost.

Specialized Team Requirements

A robust fintech product typically needs:

- Fintech software engineers

- Cloud & DevOps experts

- Security specialists (PCI-DSS, data protection, threat modeling)

- Compliance officers (KYC/AML, RBI, PCI-DSS)

- AI/ML engineers for predictive analytics & fraud detection

- Blockchain developers (for DeFi/Web3-based products)

- QA, penetration testers & auditors

A mature financial software development company provides this multidisciplinary expertise under one roof.

Typical Development Timeline

Fintech delivery cycles follow structured stages:

- PoC / Feasibility: 3–6 weeks

- Prototype / MVP: 2–4 months

- Pilot Launch: 4–6 months

- Full Production Deployment: 6–12+ months

Timelines depend on compliance requirements, integrations, and data migration complexity.

Ongoing Monitoring, Audits & Maintenance

After launch, fintech platforms require:

- Continuous security monitoring

- Fraud detection and transaction risk scoring

- Monthly/quarterly compliance audits

- API updates and partner integrations

- Feature enhancements and uptime management

This ensures your platform stays secure, compliant, and operational at scale.

Cost Ranges for Startups, SMBs, Banks & Enterprises

Costs vary based on features, user load, security depth, architecture choices, and regulatory scope.

| Business Type | Typical Cost Range | Notes |

| Startups | $25,000 – $150,000 | MVP + initial compliance |

| SMBs | $80,000 – $300,000 | Payments, lending, wallets, basic analytics |

| Banks / NBFCs | $250,000 – $2M+ | CBS integrations, advanced KYC/AML, high-volume systems |

| Enterprises | $300,000 – $5M+ | End-to-end digital banking, trading platforms, RegTech & AI systems |

Conclusion

Fintech is changing faster than ever before, and any business that does not adopt fintech software development is at risk of becoming an outcast. With safe online payments and mobile banking, financial tech to detect fraud and act as a regulator, and AI-powered trading, the latest financial services have to use the latest custom fintech solutions to remain competitive.

Collaborating with an experienced Fintech Software Development Company would guarantee that organisations are able to create secure, scalable and compliant platforms that would not only satisfy regulatory requirements but also customer expectations. It can be a startup that needs an MVP or a bank that requires modernising its core systems, or an enterprise that is venturing into digital finance: by using expert fintech development services, innovation will be accelerated, and risk will be minimised.

With the ongoing adoption of AI in digital finance, blockchain, open banking, and embedded finance, companies with high-quality digital banking software and innovative fintech capabilities will be in a position to promote growth and enhance operational efficiency and provide customers with smooth experiences.

To conclude, it is true today that a strategic investment in fintech software development lays the groundwork for a financial ecosystem that is ready to face the future; that is, secure, scalable, and able to fulfil the demands of users, regulators, and the global market.