Are you considering launching a FinTech venture or exploring innovative FinTech startup ideas through personal finance app development in the financial sector? The Fintech app development sector is experiencing rapid growth worldwide, offering enhanced security and convenience compared to traditional financial services.

Initially, FinTech apps like Moneylion primarily focused on banking and finance operations. However, technological advancements have revolutionized the entire FinTech scenario. Prime examples of such advancements are the introduction of AI, Machine learning, blockchain and more. Today, FinTech apps are widely adopted for various financial activities, from money transfers to stock investments.

We’re here to assist you in executing your ideas effectively, guiding you to Build an App Like MoneyLion tailored to your business needs.

Why Should You Build an App Like Moneylion?

In today’s landscape, FinTech app like Moneylion have become essential tools for managing the accounts,investments in the market, and other banking and financial activities. Apps like MoneyLion are assisting significant investments to increase customer engagement and expand their customer base.

The current generation is technologically advanced and is highly familiar with FinTech apps like Moneylion, actively engaging in online transactions at a drastically high rate. In the USA, the digital payment user base is forecasted to reach 320.22 million by 2027, reflecting the widespread usage of mobile banking and digital payment services all around the globe.

Statistics further states the substantial market capacity for FinTech app development in the digital transaction era:

- Digital payments have become the main source, with an anticipated total transaction value of US$2,041.00 billion in 2023.

- The largest segment in the market is expected to be Digital Payments, reaching a total transaction value of US$9,683.00 billion in 2023.

- The Neo banking segment is targeted for substantial revenue growth, projected at 25.2% in 2024.

What is the Moneylion App?

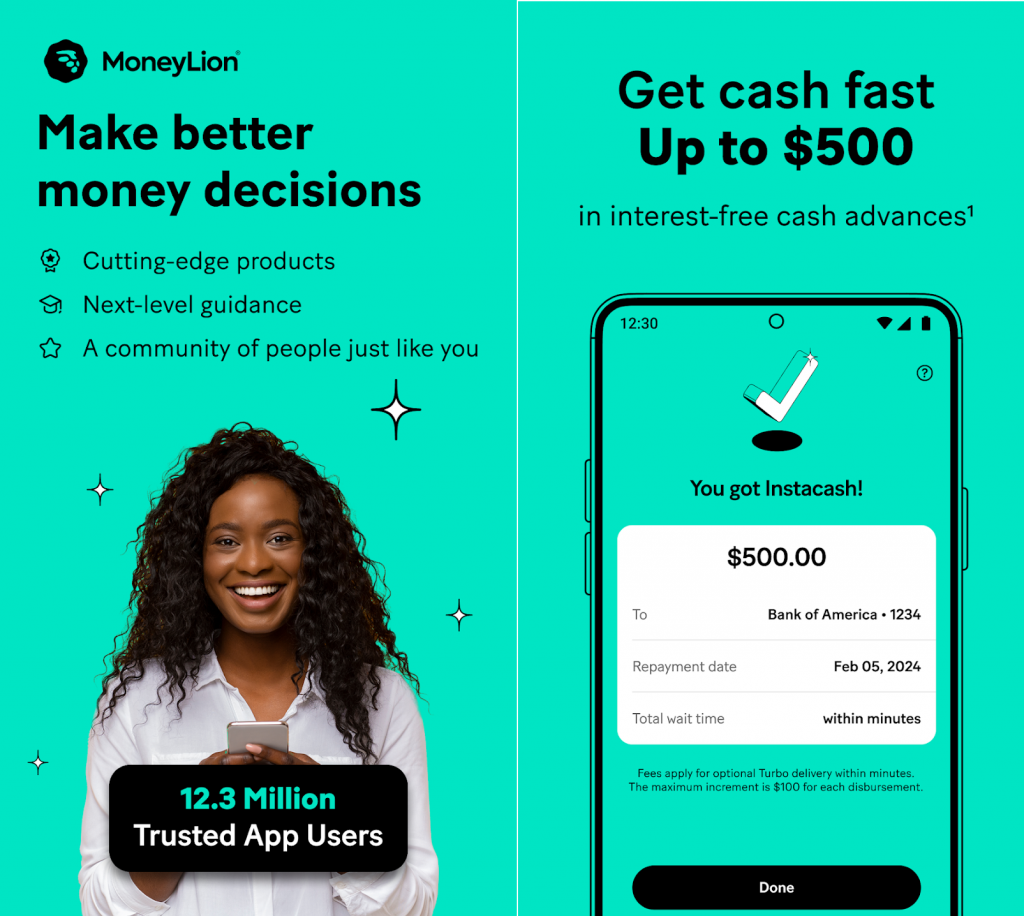

MoneyLion is a fintech app developed in 2013 to streamline financial management for their users. A variety of different financial services are integrated into a single platform which has simplified money management tasks with the help of apps like Moneylion.

Following are few simplified financial functionalities which are included in MoneyLion app:

- Banking Services: Users can access digital bank accounts via MoneyLion without any fee which eliminates the need for multiple banking apps.

- Personal Loans: MoneyLion offers personal loans with hasslefree credit checks which caters to a diverse user base seeking cash advances for emergencies or personal usage.

- Credit Insights: Users can receive an easy-to-understand analytics of their credit scores which helps them to make well-informed financial decisions.

- Customized Portfolios: The app facilitates investments in customized portfolios aligned with specific goals and risk preferences of their users.

- AI-Driven Tools: MoneyLion uses AI to deliver personalized recommendations and financial advice to their users.

In preferred, MoneyLion serves as an inclusive monetary carrier issuer which prioritizes accessibility and affordability. Whether you’re a professional investor or beginning your economic adventure, MoneyLion offers valuable assets for boosting monetary information.

Key Feature of App like Moneylion

1. Personalized Financial Advice

- The app analyzes your financial accounts and spending patterns.

- It provides tailored advice, such as identifying overpayments or excessive fees.

- Alerts help you make informed decisions to improve your financial health.

- This feature enhances your financial decision-making process.

2. Financial and Credit Tracking:

- The “Financial Heartbeat” feature monitors key factors.

- It tracks spending, income, and credit health.

- Visualize trends and identify areas for improvement.

- Stay on top of your financial well-being.

3. Budgeting and Saving Tools:

- Swipe through advice on overspending in specific categories.

- Receive alerts when spending exceeds your budget.

- Set personalized savings goals.

- Manage your finances effectively.

4. Daily Tips and Educational Content:

- Get customized tips based on your financial goals.

- Access relevant news and educational articles.

- Stay informed and learn about financial best practices.

- Continuous learning supports better financial habits.

5. Mobile Banking:

- Check near real-time balances across accounts.

- Transfer funds easily between accounts.

- Set up customized alerts for account activity.

- Conveniently manage your money on the go.

6. Credit Building and Monitoring:

- MoneyLion’s Credit Builder Plus membership offers:

- Loans up to $1,000 to build credit.

- Reporting to all three credit bureaus (Equifax, Experian, TransUnion).

- 24/7 credit monitoring for security.

- Improve your credit score over time.

7. Interest-Free Cash Advances:

- Access Instacash cash advances up to $250.

- No interest charges or credit checks.

- Useful for emergencies or unexpected expenses.

- Provides short-term financial relief.

8. Early Paycheck Access:

- – If your paychecks are directly deposited, get money upfront.

- – Unique feature among credit-building programs.

- – Helps bridge gaps between paydays.

- – Offers flexibility and financial stability.

9. Reports to All Three Major Credit Bureaus

- MoneyLion reports your credit activity to Equifax, Experian, and TransUnion.

- Positive reporting helps build credit history.

- Responsible financial behavior reflects in your credit score.

- Establish a strong credit profile.

10. No Monthly Fees with Qualified Activities

- Meet specific criteria to avoid monthly fees.

- Encourages active engagement with the app.

- Enjoy fee-free banking and financial services.

- Rewards responsible financial behavior.

Trending Fintech Apps in the USA

Fintech apps have revolutionized the way people manage their finances. Here are five popular fintech apps in the USA:

- Chime: Founded in 2012, Chime is a neobanking app that offers services like unfastened account setup, instant money transfers, app take a look at deposits, bill bills, and ATM locators. It’s to be had for each Android and iOS gadget.

- Mint: Mint is a famous app that allows customers manipulate their price range by using monitoring fees, transactions, and credit rankings. It also offers budgeting tools and bill fee features.

- MoneyLion: Operating as component lending, component savings, and component wealth management app, MoneyLion presents financial advice, get right of entry to loans, and private finance management. It’s one of the pleasant fintech apps in the USA.

- Acorns: Acorns specializes in micro-investing by way of rounding up your ordinary purchases and investing the spare change. It’s an exceptional manner to start making an investment without a whole lot of effort.

- Robinhood: Known for its fee-unfastened inventory buying and selling, Robinhood has won reputation amongst buyers. It permits customers to shop for and promote shares, ETFs, and cryptocurrencies without difficulty via its app.

Remember that the fintech landscape is dynamic, so there may be other emerging apps as well. These five apps, however, have gained popularity for their user-friendly features and convenience.

How to Build an App Like MoneyLion?

Define Your Vision and Objectives:

-

-

- Aspirations and Vision: Begin by clarifying your goals and aspirations for the app. What problem will it solve? How will it benefit users?

- Unique Value Proposition: Clearly articulate how your app stands out from existing solutions. For instance, app like Moneylion focuses on straightforward investment options—what will be your app’s unique selling point?

- Guiding Principle: Use Moneylion’s emphasis on simplicity and user-friendly investment choices as a guiding principle for your development process.

-

Research and Market Analysis:

-

-

- Thorough Research:

- Market Trends: Investigate current trends in Personal finance app development. What are users looking for? What pain points can your app address?

- Demographics: Identify your target audience. Understand their preferences, behaviors, and needs.

- Competitor Analysis: Study other developments similar to MoneyLion app development, including their successes and challenges. Learn from their strategies.

- Market Gaps and User Expectations:

- Gap Analysis: Identify areas where existing solutions fall short. What can your app do differently?

- User Expectations: Understand what users expect from a fintech app. Consider features, security, and ease of use.

- Thorough Research:

-

Assemble a Competent Development Team:

-

- Skillful Developers:

- Security Experts: Hire dedicated developers well-versed in security practices. Fintech app development handles sensitive data, so robust security is crucial.

- Mobile App Developers: Find experts in mobile app development (iOS, Android) to create a seamless user experience.

- Fintech Knowledge: Look for fintech app developers with domain expertise in financial technology.

- Stay Updated:

- Technology Trends: Keep your team informed about emerging technologies like blockchain, AI, and data encryption.

- Collaboration: Work closely with QA engineers, backend developers, and UI/UX designers to cover all aspects of development.

- Skillful Developers:

Choose the Right Technology Stack:

-

-

- Backend Framework: Opt for a stable backend framework such as Java or Python. This choice impacts performance and scalability.

- Leverage Cloud Services: Integrate cloud services for seamless scalability and flexible storage options.

- Alignment with App Characteristics: Ensure your technology choices align with your app’s specific needs. Consideration must be given to MoneyLion app development cost while choosing the right technology stack.

-

Focus on User-Centric Design:

-

-

- Intuitive Design Principles:

- Prioritize user experience (UX) by following intuitive design principles.

- Learn from Stash’s user-friendly interface—make navigation and interactions seamless.

- User Testing:

- Conduct thorough user testing to enhance usability and engagement.

- Features like personalized dashboards and real-time updates improve overall UX.

- Long-Term Retention:

- A visually appealing and user-focused design not only attracts users initially but also encourages long-term usage.

- The more it is appealing to the users, the more it is going to affect the Cost to Build an App Like MoneyLion.

- Intuitive Design Principles:

-

Develop Core Features and Security Measures:

-

- Essential Features:

- Create features like investment portfolios and transaction monitoring.

- Prioritize functionality that aligns with your app’s purpose.

- Security Considerations:

- Implement robust authentication methods (e.g., OAuth, JWT) to protect user data.

- Use encryption standards to safeguard sensitive information.

- Adhere to industry compliance regulations.

- Explore biometric recognition and two-factor authentication for enhanced privacy.

- Consultation: Always consult with a reputed fintech app development company for robust security measures to build personal finance app.

- Essential Features:

Integrate Third-Party APIs:

- Reliable APIs: Choose reputable third-party APIs that align with your app’s functionality. Examples include APIs for financial data collection, payment processing, and identity verification.

- Streamlined Development: By integrating existing APIs, you save development time and ensure data accuracy.

- Collaborate with E-Wallet Providers: Partner with e-wallet app development services to enhance user experience. Seamless API integration expands your app’s functionality and appeal.

Implement Routine Testing and Strategic Launch:

- Usability Testing:

- Conduct usability tests to identify any user experience issues.

- Optimize navigation, responsiveness, and overall usability.

- Security and Functionality Testing:

- Rigorously test security measures (authentication, encryption) to safeguard user data.

- Verify core features (investment portfolios, transaction monitoring) for functionality.

- Smart Launch Strategy:

- Plan a strategic launch:

- Consider timing, target audience, and marketing efforts.

- Address any issues or flaws identified during testing.

- Plan a strategic launch:

- Continuous Updates:

- Release regular updates to stay relevant in the evolving financial landscape.

- Prioritize user feedback and adapt to market trends.

How Much does It Cost to Build an App Like Moneylion?

If you’re considering the Moneylion app development cost, it’s critical to understand the variables influencing the task’s complexity and capability. Typically, any such assignment ought to variety from $10,000 to $25,000 or greater, relying on various factors.

1. Development Team Costs:

A significant portion of the expense involves hiring a skilled Personal finance app development company, encompassing UI/UX designers, frontend and backend developers, QA engineers, and possibly data scientists. Remuneration discrepancies due to location and experience significantly impact overall costs.

2. Design and User Experience:

Investing in user-centric design is crucial for a successful finance app. MoneyLion app development cost for UI/UX design, prototyping, and user testing ensure an engaging interface that enhances user interaction.

3. Security Measures:

Given the sensitive financial data handled, robust security measures are imperative. Costs associated with industry compliance, encryption, and authentication techniques contribute to the overall budget.

4. Regulatory Compliance:

Ensuring compliance with financial regulations necessitates legal advice, compliance checks, and feature implementation aligned with industry standards. These compliance measures increase cost to build a fintech app and complexity.

5. Testing and Quality Assurance:

Thorough testing is essential to identify and rectify issues pre-launch, comprising a significant portion of the budget. Investing in extensive testing upfront mitigates long-term expenses associated with addressing issues post-launch.

6. Technology Stack:

Opting for the appropriate technological stack influences scalability and development efficiency. Costs are incurred for databases, cloud services, and frontend and backend technologies. Additionally, expenses related to third-party integration services or licensed software impact the MoneyLion app development cost.

7. Maintenance and Updates:

Post-launch, continuous maintenance is essential to address bugs, implement updates, and adapt to market shifts. Allocating resources for ongoing development ensures the software remains current and secure, contributing to the overall mobile app development cost.

Conclusion

To build an app like MoneyLion calls for a strategic making plans that actions parallel with marketplace demands and priority of its users. By crafting a clean vision, undertaking in depth studies, hiring an experienced development company, and prioritizing user-friendly design, you could lay the inspiration for a successful fintech commercial enterprise. Consideration of center features like customized economic advice, sturdy security features, and flawless integration.

However, it’s critical to bear in mind the fintech app development cost, which includes mobile app development costs, UI/UX designs, safety features, testing, technology stack, and habitual renovation. However the fintech app development cost might also vary relying on venture complexity and capability, allocating resources strategically guarantees the app’s competitiveness and relevance within the converting fintech landscape. Start your private finance app development journey with Technoyuga, a reputable mobile app development company, which revels in fintech app development through the years.