In 2024, when faced with a cash shortage and in need of a small loan to bridge the gap until the next paycheck, individuals often turn to apps like Earnin for a convenient solution. However, the abundance of options available can make it challenging to determine the best choice.

Earnin stands out among these apps due to its popularity among individuals facing financial constraints between paydays. One key factor contributing to its appeal is its transparency, as it does not involve hidden fees or subscription requirements.

However, Earnin is just one of the many mobile app development options available for quick access to additional funds. In this regard, several other apps like Earnin exist, each offering unique features, eligibility criteria, limits, and associated fees. It is essential for users to carefully review the terms and conditions of each app before proceeding with enrollment to ensure alignment with their financial needs and preferences.

Table of Contents

ToggleList of Top 10 Apps Like Earnin

Discover today’s top apps like Earnin with these 10 outstanding alternatives that offer similar functionalities and benefits for users in need of quick access to funds.

- Dave

- MoneyLion

- Cleo

- Chime

- Empower

- Varo

- Brigit

- Vola

- Possible Finance

- Payactiv

Let’s discuss each of the above apps like Earnin in detail with their features, functionalities and their respective pros and cons.

1. Dave

Dave is a personal finance app which offers its ExtraCash™ feature, providing a no-interest, no-fee cash advance of up to $500. Unlike traditional payday lenders, Dave doesn’t check your credit history, making it accessible even if you have bad credit. Here’s what sets Dave apart:

- Express Transfers: You can choose between a free standard transfer (1-3 business days) or an express option (minutes to a few hours) with fees ranging from $1.99 to $13.99.

- Credit Building: Dave partners with Level Credit, reporting your rent payments to major credit bureaus, helping you improve your credit score.

- Account Alerts: Dave notifies you when your account balance is low, preventing overdraft fees.

- Membership Fee: Access to Dave requires a $1 monthly subscription fee, granting you budgeting tools, low balance alerts, and savings goal features.

Pros of Dave App

- No late fees

- Side hustle job search assistance

- Personalized budgeting tool

Cons of Dave App

- Monthly subscription fee

- Standard transfers take time

- Express turnaround fees apply

2. MoneyLion

MoneyLion, a personal finance app like Earnin, provides a suite of banking tools designed to enhance your financial management. Here’s what you need to know:

- RoarMoney Account: Gain early access to your direct deposit paychecks.

- Credit Builder Plus: Access credit-builder loans up to $1,000 repayable over 12 months (with a $19.99 monthly fee). MoneyLion reports payments to major credit bureaus, aiding credit score improvement.

- Instacash: Get cash advances up to $500 at 0% APR. Standard delivery takes up to five business days, while turbo delivery (within minutes to four hours) incurs fees ranging from $0.49 to $8.99 (higher for external accounts).

- Eligibility: You need an active linked checking account open for at least two months, direct deposits, and a positive balance.

Pros of MoneyLion App

- Interest-free cash advances

- Comprehensive mobile banking features

- $1,000 cash advance limit for MoneyLion users

Cons of MoneyLion App

- Partial payment withdrawals until full repayment

- $1 monthly membership fee

3. Cleo

Cleo is more than just a money management tool, it also acts as your savvy financial friend. With witty quips and motivating messages, Cleo guides your spending and savings.

Here’s what you need to know about Cleo:

- Cash Advances: Cleo allows small cash advances. First-timers can borrow between $20 and $100, but timely repayments can increase the limit up to $250.

- Interest-Free: The cash advance has no interest, and it won’t impact your credit score.

- Flexible Repayment: You can choose a repayment date within three days to two weeks.

- Subscription Plans:

- Cleo Plus ($5.99/month): Offers cashback rewards.

- Cleo Builder ($14.99/month): Provides savings and budgeting assistance.

- Eligibility: Gig workers and freelancers qualify.

Pros of Cleo App

- Cashback rewards (premium plan)

- Savings and budgeting tools

Cons of Cleo App

- Monthly subscription required

- $250 maximum limit

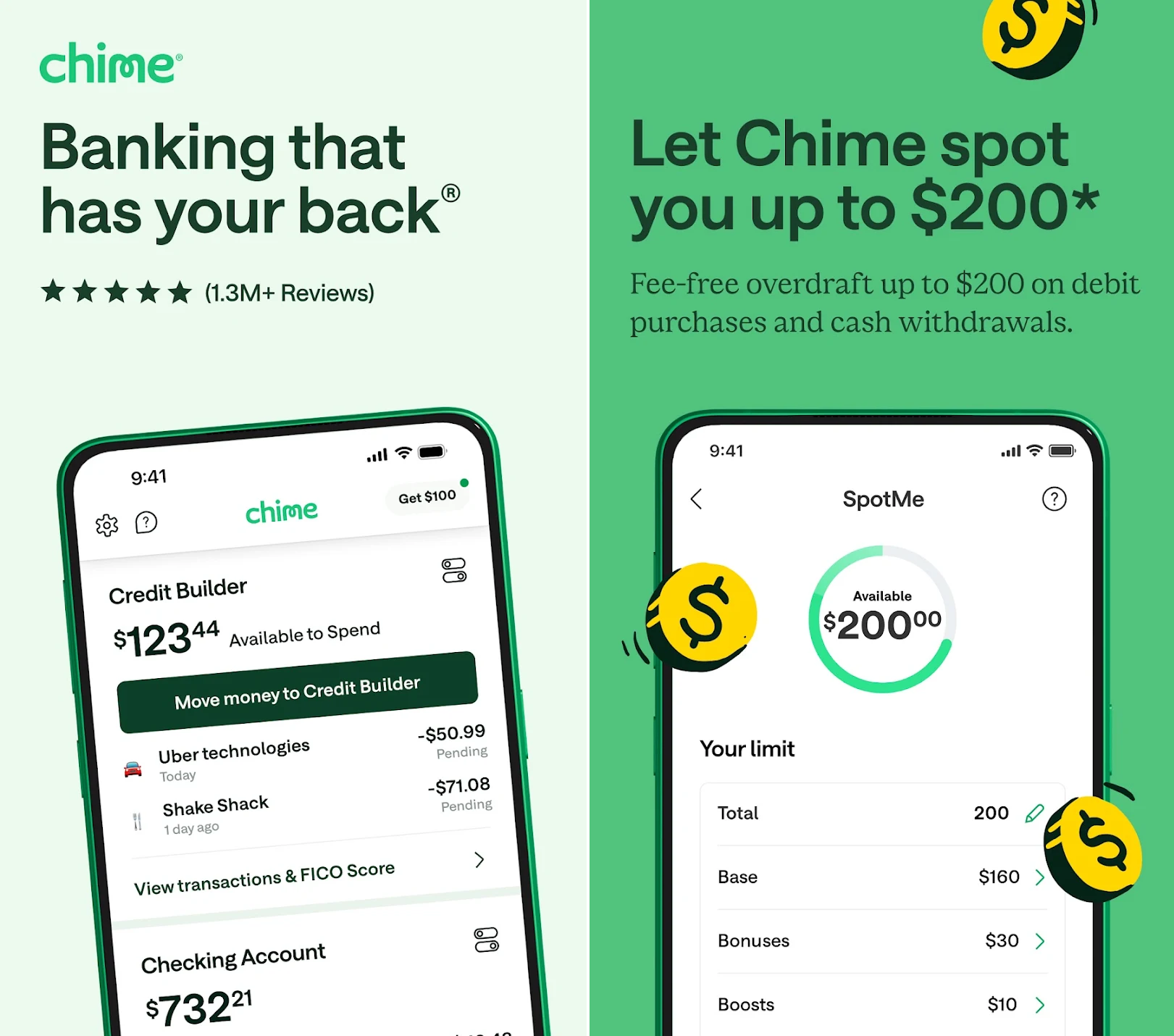

4. Chime

Chime, a digital finance company, offers a suite of banking features, including a checking account, a credit-building credit card, and a high-yield savings account. While Chime doesn’t provide cash advances, it does offer overdraft protection through its SpotMe® program.

Here’s what you need to know:

- SpotMe® Overdraft Protection: If you overdraft your spending account, SpotMe® covers you up to $200, and you won’t incur any overdraft fees.

- Eligibility: To qualify for SpotMe®, you need a qualifying direct deposit of at least $200 in your account each month.

Pros of Chime

- Multiple banking features

- Up to $200 coverage for overdrafts

- No membership fees, overdraft fees, or tips

Cons of Chime

- Available only to Chime users with direct deposit

- Low starting limit of $20

5. Empower

Empower, formerly known as Personal Capital, focuses on helping clients enhance their credit similar to apps like Earnin and Dave. With Empower, you can receive a cash advance of up to $250 without worrying about late fees or credit checks. The funds are instantly delivered, and there are no interest charges.

Users can open an Empower debit card account to deposit funds or transfer them to an external bank. This account offers valuable features, including overdraft fee protection, early paycheck access, and up to 10% cashback on purchases.

However, to access Empower’s money management tools, including cash advances, you’ll need a monthly subscription. There’s a 14-day free trial, after which the subscription costs $8 per month.

Pros of Empower

- No late fees or interest.

- Debit card compatible with Apple Pay, Google Pay, and Samsung Pay.

Cons of Empower

- Empower monthly subscription ($8) required.

- Only available on mobile (no web access)

6. Varo

Varo, one of the apps like Earnin that works with Chime, is a digital bank which offers a suite of banking services, including a debit card, a high-yield savings account, and an extensive ATM network. Their Varo Advance feature allows you to receive an initial cash advance of up to $250, with the potential to increase it to $500 over time. However, there’s a fee associated with each advance, ranging from $1.60 to $40, depending on the amount borrowed. To qualify, ensure you have an active Varo debit card linked to your account and at least $800 in direct deposits within the past month.

What sets Varo apart is its flexible repayment window: you have 15 to 30 days to pay back the advance, rather than an automatic withdrawal on your next payday.

Pros of Varo

- Extended repayment period (15-30 days).

- No monthly fees.

- Early access to your paycheck through Varo.

Cons of Varo

- High fees for each advance.

- Initial advances may be relatively low.

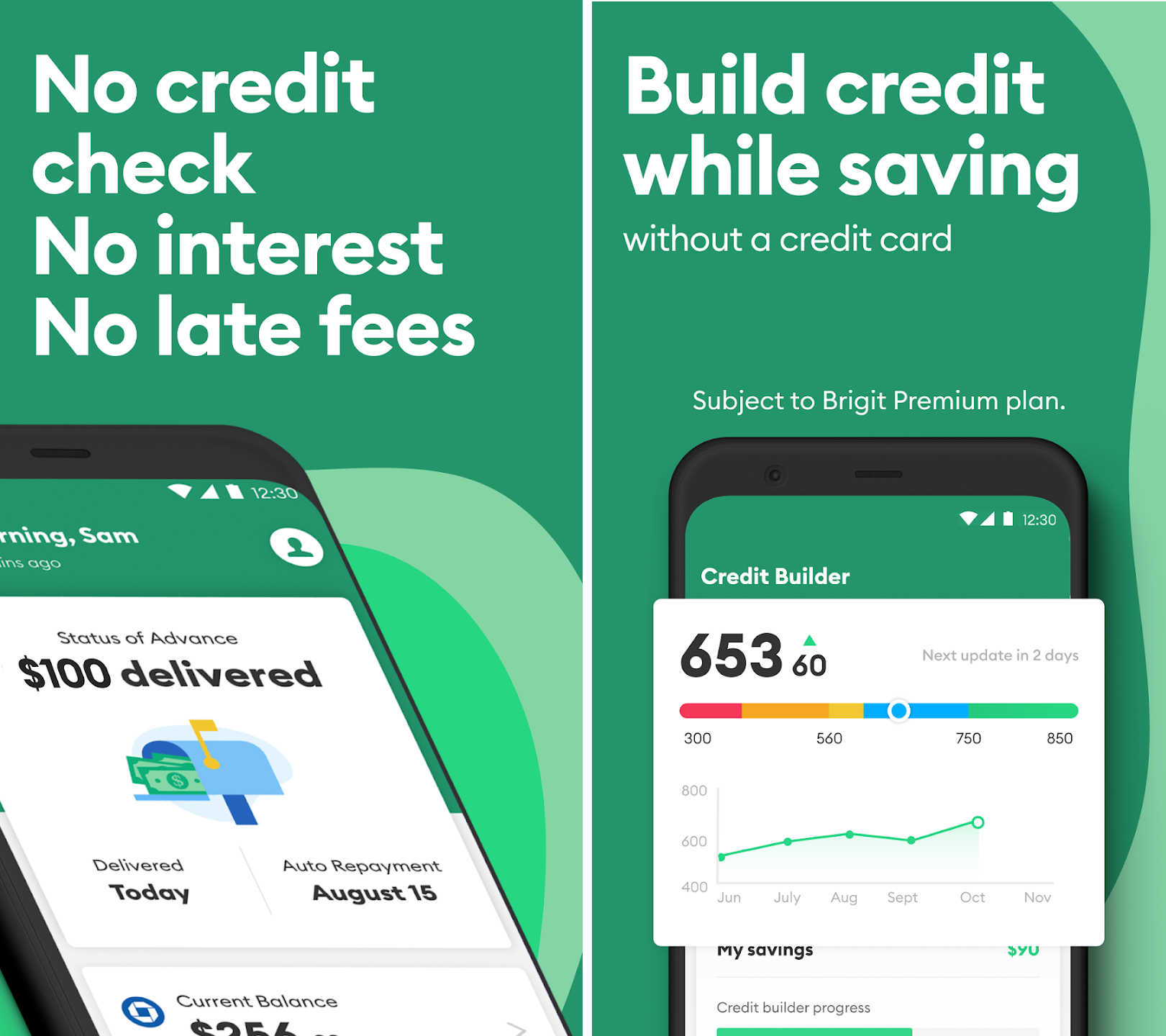

7. Brigit

Brigit, a financial wellness tool, assists users with budgeting, spending insights, and “Instant Cash” cash advances of up to $250. Here’s how it works:

- Instant Cash: You can receive your advance within two to three business days for free or opt for Express Delivery (for a small fee) that arrives in minutes. No credit check, interest charges, late fees, or tipping are involved. Brigit also provides overdraft protection, transferring up to $250 to prevent costly overdraft fees.

- Plus Plan Subscription: To access these features, you’ll need to subscribe to the Plus plan ($9.99 per month). This plan includes additional services like credit monitoring, finance helper, and identity theft protection.

- Credit-Builder Loans: Brigit offers credit-builder loans with flexible repayment plans. You can choose to pay between $1 and $25 per month over a 24-month term. Payments are reported to major credit bureaus, aiding in credit building.

Pros of Brigit App

- Up to $1 million in identity theft protection.

- No interest, fees, or tipping.

- Easy payment plans for credit-builder loans.

Cons of Brigit App

- Bank account access required.

- Monthly membership fee of $9.99 for cash advances

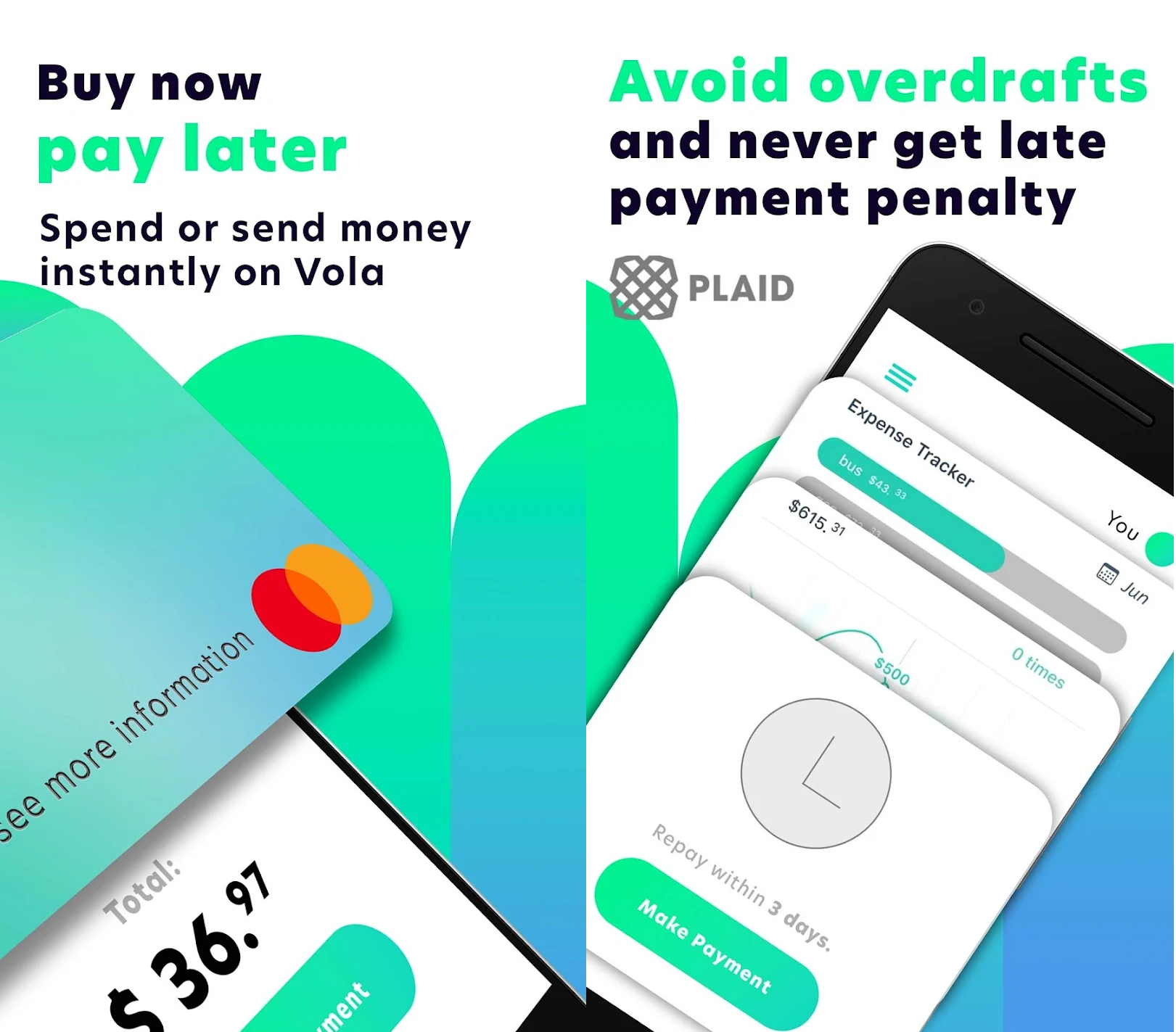

8. Vola

Vola Finance provides cash advances of up to $300; in most cases, you can receive money within 5 hours. Unlike most apps, you do not need regular direct deposits to be eligible for a cash advance. You should qualify as long as your account has regular activity and an average balance of at least $150.

While Vola appears to have one of the most straightforward cash advance processes, you must enroll in a monthly plan starting at $1.99. Unfortunately, fee information is not easily found on Vola’s website.

A unique feature of Vola is your Vola Score, which can range from 0 to 100. You can qualify for lower subscription fees and larger cash advances as your score increases.

Pros of Vola

- Quick turnaround time

- Easy qualifications

Cons of Vola

- Monthly fee required

- Website lacks information about its monthly plans.

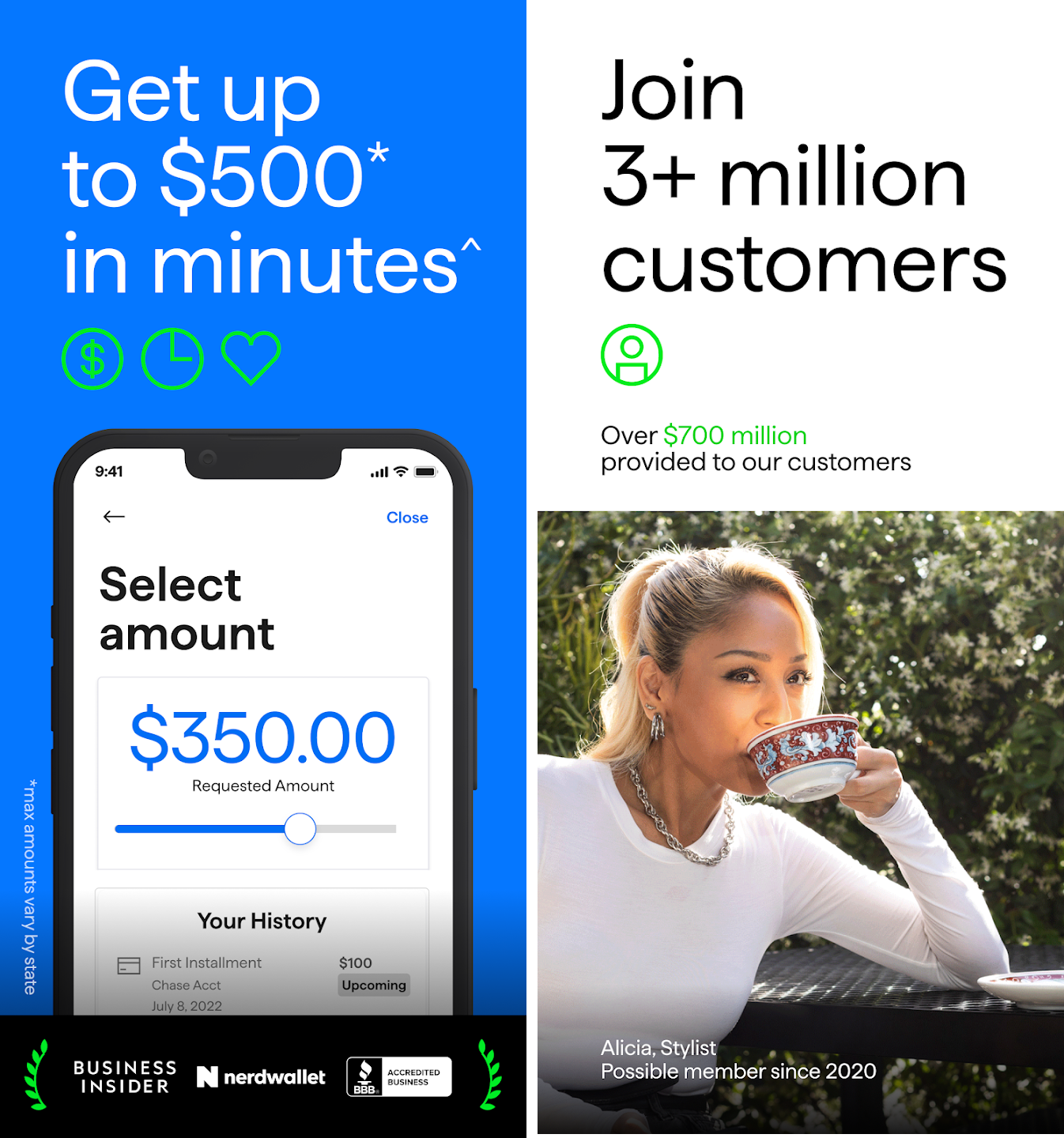

9. Possible Finance

Possible Finance, one of the apps like Dave and Earnin, is a digital lending platform that provides small loans, typically up to $500, even for individuals with bad or no credit history. Unlike Earnin, which deducts repayments from your next paycheck, Possible Finance divides repayments into four installments over a two-month period. Moreover, Possible Finance does not require a subscription or impose monthly fees, making it a suitable choice for those seeking a one-time loan.

However, one significant drawback of Possible Finance is its high Annual Percentage Rates (APRs), which can range from 50% to 249%, varying depending on the borrower’s state of residence. Another consideration is that Possible Finance is currently only accessible in approximately a dozen states, so it’s crucial to verify its availability in your area before applying.

Pros of Possible Finance

- No subscription or monthly fee

- Repayment schedule spread out over two months

Cons of Possible Finance

- High APRs

- Limited availability, not accessible in all states

10. Payactiv

PayActiv is a financial app available to employees through their employers, who must offer it as a benefit. Once connected with your employer, PayActiv tracks your hours and allows you to access up to 50% of your earned wages.

You have the flexibility to transfer your earnings to your bank account, debit card, or PayActiv Visa card. When your next direct deposit is received, PayActiv automatically deducts the amount borrowed. Additionally, the app offers various financial services, including prescription discounts, bill payment options, and automatic savings contributions.

Pros of Payactiv

- Available for both salaried and hourly employees

- Access to up to 50% of earned wages

- Highly rated app for user satisfaction

Cons of Payactiv

- Availability depends on employer offering the service

- Potential fee of up to $5 if direct deposit is unavailable

Guidelines for Selecting an App Similar to Earnin

When selecting a cash advance app like Earnin, it’s crucial to consider various features based on your financial needs and preferences. Here are some key factors to keep in mind so that you can also explain it later to dedicated developers to create an app like Earnin.

- Cash Advance Limits

Evaluate the cash advance limits offered by different apps to ensure they meet your financial requirements. Most apps have limits ranging from $100 to $1,000, but some may offer higher limits once you demonstrate responsible repayment behavior.

- Customer Service Availability:

Since cash advance apps are primarily mobile-based, assess the level of customer support provided by each app. Consider factors such as availability, communication channels, and response times. Reviews on platforms like Trustpilot and Better Business Bureau can offer insights into the quality of customer support offered by each app.

- Eligibility Requirements:

Understand the eligibility criteria set by each app, which typically include age, employment status, income level, and banking arrangements. Requirements may vary, but generally, you’ll need to be at least 18 years old and have proof of employment with regular direct deposits into an active bank account.

- Fees and Interest:

Carefully review the fee structure associated with cash advances, including subscription fees, transaction fees, interest charges, late fees, and delivery fees. Be aware of any potential expenses and consider whether the benefits of the app outweigh the costs.

- Financial Tools:

Explore additional financial tools offered by cash advance apps beyond basic advances. Some apps provide features for managing multiple accounts, building credit, budgeting, saving, and earning cash-back rewards. Assess whether these additional tools align with your financial goals and preferences.

- Turnaround Time:

Consider the turnaround time for receiving funds through each app, especially if you need cash urgently. Some apps offer quick transfers within hours, while others may take several business days. Be prepared for potential fees associated with expedited delivery options.

Ultimately, choose a cash advance app that best fits your financial needs, offers transparent terms, and provides reliable customer support. By carefully evaluating these factors, you can select an app that helps you manage your finances effectively and navigate unexpected expenses with confidence.

How Much Does It Cost to Develop An App Like Earnin?

The cost to develop an app like Earnin can vary significantly based on various factors such as features, complexity, development time, and hourly rates of developers. Typically, building a basic version of a cash advance app like Earnin can range from $20,000 to $50,000. The mobile app development cost includes essential features like user registration, income verification, payment processing, and basic security measures.

However, if your team of dedicated developers want to incorporate advanced functionalities such as personalized financial tools, real-time notifications, advanced security features, and integration with banking systems, the cost can increase substantially. Developing such a comprehensive app on android and IOS through android app development or Iphone app development may require an investment of $50,000 to $100,000 or more, depending on the scope and scale of the project.

Additionally, ongoing maintenance and updates should also be factored into the overall cost estimation for ensuring the app’s long-term success and functionality.