Gone are the days of waiting in long queues at banks and enduring the hassle of filling out forms to send money. The emergence of payment apps has transformed the way people transfer funds, offering a seamless and instantaneous process with just a few taps on a mobile device.

This paradigm shift in money transfer methods has spurred a significant rise in the global market size for mobile payments, projected to reach a staggering $9.4 billion by 2025.

With this growing demand, both fintech startups and established financial institutions are keen on exploring the Money Transfer App Development. However, navigating the complexities of creating such apps is no easy feat.

Table of Contents

ToggleUnderstanding Money Transfer Apps

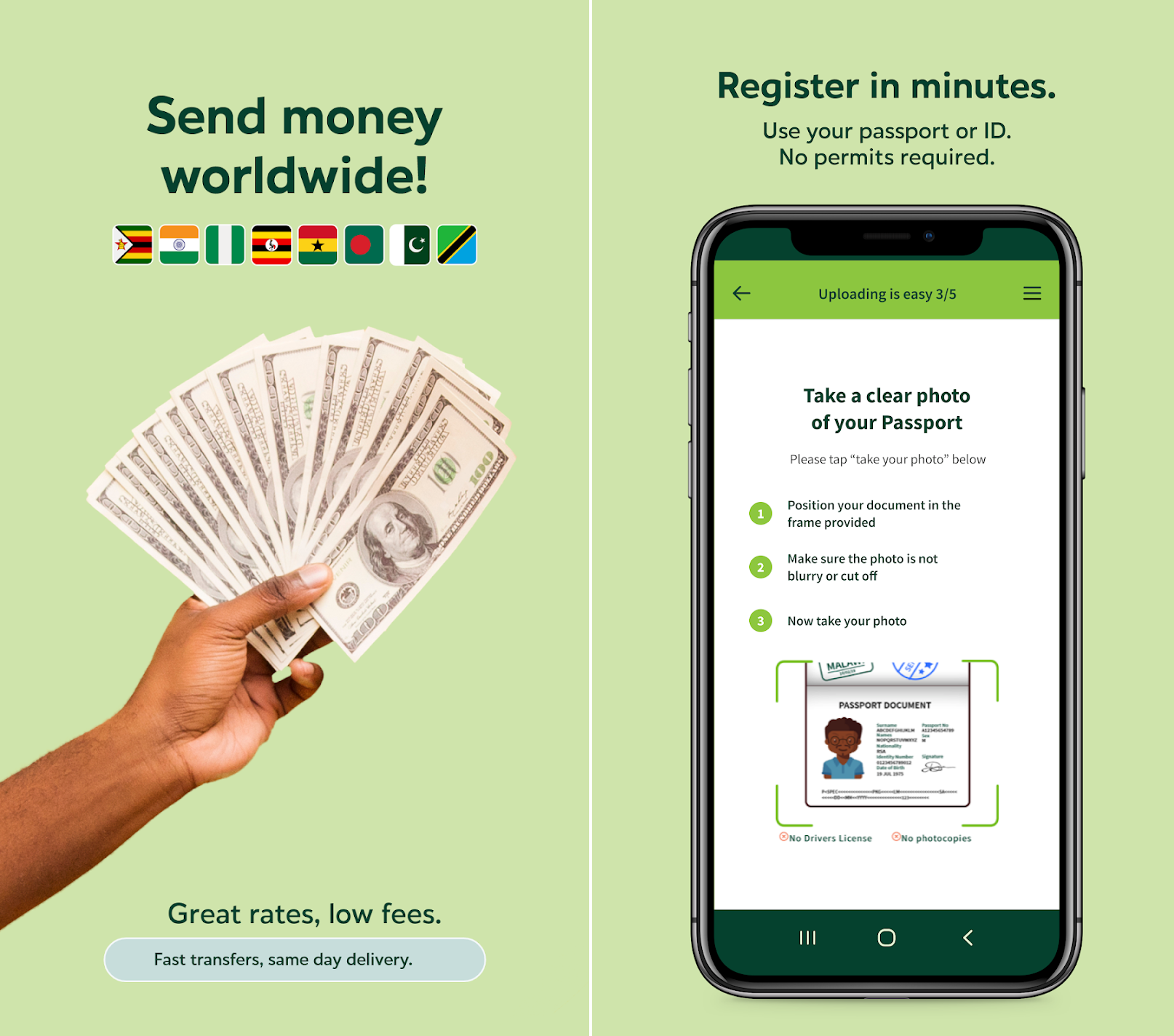

Money transfer apps like Mama Money, also known as P2P payment apps, are mobile applications that enable users to send funds directly to recipients without the need for intermediaries like banks.

By leveraging the convenience of smartphones, users can simply download a money transfer app and initiate transactions using the recipient’s email address or phone number. Unlike traditional banking methods, these apps offer a streamlined and cost-effective solution for transferring funds, making it accessible to a broader audience.

The Process of Using a Money Transfer App

Using a money transfer app is straightforward and user-friendly, making it an attractive alternative to traditional banking channels. Here’s how it typically works every business owner should know before they build an app like Mama Money.

- Connect the app’s e-wallet to a banking account: Users link their bank accounts to the money transfer app, allowing seamless transfer of funds between the two platforms with the help of Ewallet on demand app development.

- Deposit an initial amount: To initiate transactions, users need to deposit funds into their app’s e-wallet, which serves as the source of funds for transfers.

- Provide recipient details: Users input the recipient’s contact information, such as phone number or email address, to identify the recipient of the funds.

Specify the transfer amount: Users indicate the amount they wish to transfer to the recipient.

Confirm the transfer: After verifying the transaction details, users confirm the transfer, initiating the fund transfer process.

Enhanced Features of Modern Money Transfer Apps

In addition to facilitating peer-to-peer fund transfers, modern money transfer apps like Mama Money offer a range of financial features that rival traditional banking services.

Here are some of the essential features as explained by the mobile app development company professionals. Keep an eye on the following features before you build an app like Mama Money.

- Bill payment capabilities: Users can conveniently pay bills directly through the app, eliminating the need for separate bill payment platforms.

- Expense tracking: Money transfer apps provide tools for users to track their expenses and manage their finances more effectively.

- Multi-currency support: Some apps support transactions in multiple currencies, catering to users with international transfer needs.

- Transaction reporting: Users can generate detailed reports of their transactions for accounting and auditing purposes.

Types of Money Transfer Apps

Money transfer apps like Mama Money come in various forms, each catering to different user needs and preferences. Are you also planning to build an app like Mama Money? Have a look at the following types of apps.

- Mobile OS Payment: Examples include Apple Pay and Android Pay, which are integrated into mobile operating systems and offer seamless fund transfers using NFC technology.

- Independent Services: Non-traditional digital payment providers offer standalone apps for secure and convenient fund transfers.

- Online Banking Services: Traditional banks have also digitized their services to support P2P payments, adapting to the changing landscape of financial technology.

The development of money transfer apps represents a significant advancement in financial technology, revolutionizing the way people conduct transactions. By offering convenience, accessibility, and enhanced features, these apps are reshaping the future of money management and financial transactions.

As the demand for such apps continues to grow, the development of innovative solutions in this space, like Mama Money, holds immense potential for driving financial inclusion and empowerment on a global scale.

Creating a Money Transfer App: Simplified Development Process in 6 Steps

Developing a money transfer app requires meticulous planning, execution, and support to ensure its success in the competitive market. Here’s a streamlined approach our software team follows to guide you through the development cycle:

Step 1: Conduct Comprehensive Analysis

Before diving into development, it’s crucial to conduct thorough business and technical analyses to validate the viability of your money transfer app idea. Start by assessing the demand for your app through competitor analysis, user surveys, and stakeholder interviews.

Identify any niche features or services that could set your app apart in the market. Additionally, delve into the technical considerations, such as security, compliance, and infrastructure requirements, to ensure a smooth development process.

Step 2: Design the User Experience

Designing an intuitive and user-friendly interface is essential for driving adoption and retention rates. Begin by mapping out the user journey using mind-maps and wireframes, and seek feedback from potential users to refine your designs. Pay close attention to UI/UX elements such as screen layouts, graphics, colors, and navigation to create a visually appealing and mobile-friendly experience. Prioritize simplicity and ease of use to ensure seamless money transfers and fund management for your users.

Step 3: Plan the Development Process

Building a money transfer app requires assembling a skilled and multidisciplinary team of software experts. The money transfer app company should hire dedicated developers which includes mobile app developers, backend developers, project managers, business analysts, QA engineers, and security experts.

Decide whether to hire an in-house team or outsource the development to IT partners based on your budget and resource constraints. Define your app requirements, essential features, project goals, and stakeholder expectations to create a roadmap for development. Establish clear timelines for key milestones to stay on track and align with your marketing efforts.

Step 4: Develop the App

With the groundwork laid out, it’s time to kick off the development process. Developers will begin coding the app based on the finalized designs and specifications. Ensure seamless integration of features, functionality, and services while considering security, user experience, and business logic. Divide the development tasks among different teams, such as backend and mobile developers, to work concurrently and maximize efficiency. Maintain regular communication and progress tracking to avoid confusion and delays during development. In short, the developer focuses on developing money transfer apps compatible for different operating systems such as android app development and iphone app development.

Step 5: Integrate Third-Party Services

To enhance the functionality of your money transfer app, consider integrating with third-party services that offer complementary features. This approach accelerates development by leveraging existing solutions and allows you to focus on building your app’s core business logic. Integrate with services such as bill payment systems, KYC providers, credit card networks, banks, ATM networks, and AML services to offer a comprehensive payment solution to your users.

Step 6: Test, Release, and Support

Before launching your money transfer app, conduct thorough testing to identify and resolve any bugs, technical issues, or security vulnerabilities. Implement unit, functional, acceptance, and regression tests to ensure the app meets quality standards and user expectations. Once testing is complete, prepare for deployment by setting up the necessary infrastructure and backend services. Release the app on major marketplaces like the App Store and Play Store, and closely monitor its performance post-launch.

For example, an iPhone app development company releases their apps on the App store, which is compatible for all IOS users. Provide robust after-launch support to address user queries and feedback promptly, ensuring a seamless experience for your users and driving continued engagement with your app.

By following these six essential steps, you can successfully navigate the development cycle to build an app like Mama Money and deliver a reliable and user-friendly solution to meet the evolving needs of modern consumers.

Enhancing User Experience: Essential Features and Integrations for Money Transfer Apps

In the rapidly evolving landscape of fintech, user-centric design has become paramount for the success of peer-to-peer payment apps. To cater to diverse market segments effectively, it’s essential to incorporate features that prioritize simplicity, engagement, and utility. Here are key features to build an app like Mama Money should include:

- Seamless Onboarding Experience: Simplify the account creation process while ensuring compliance with regulatory requirements such as KYC and AML. Provide clear, step-by-step guidance to users, minimizing barriers to entry and reducing abandonment rates.

- Robust Profile Management: Empower users to manage their profiles effortlessly, enabling them to update personal information, banking details, and contact information within the app’s interface.

- E-Wallet Functionality: Introduce digital wallet capabilities that enable users to conveniently deposit funds from their bank accounts or credit cards. E-wallets facilitate contactless transactions at participating merchants, enhancing convenience and flexibility for users.

- Streamlined Money Transfer: Make money transfer functionality easily accessible from the app’s dashboard, allowing users to send funds to recipients via email, phone number, or bank account. Ensure intuitive navigation and seamless execution of transactions to enhance user satisfaction.

- Convenient Bill Payment Options: Integrate the app with service providers to facilitate online bill payments directly from users’ mobile devices. Offering this feature enhances the app’s utility and appeal, providing users with a comprehensive financial management solution.

- Detailed Transaction History: Enable users to access comprehensive transaction records, including details such as transaction dates, fees, recipients, destinations, and payment purposes. This feature enhances transparency and accountability, empowering users to track their financial activities efficiently.

- Proactive Event Notifications: Keep users informed and engaged by providing timely notifications for important events, such as fund transfers, receipt confirmations, promotions, security updates, and subscription renewals. Proactive communication enhances user trust and satisfaction, fostering a positive app experience.

By prioritizing these user-centric features and integrations, money transfer apps can deliver a seamless and engaging experience that meets the diverse needs of modern consumers in the rapidly evolving fintech landscape. The money transfer mobile app development cost may vary depending upon the inclusion and exclusion of the above mentioned features.

Exploring the Potential of Generative AI in Money Transfer Apps

Generative AI holds significant promise for enhancing the user experience and security of peer-to-peer payment platforms. By leveraging generative AI technology, money transfer apps can unlock various benefits, including improved fraud detection, personalized user experiences, and the integration of AI chatbots for customer support.

- Enhanced Fraud Detection: Generative AI algorithms have the capability to analyze vast amounts of transaction data in real-time, enabling money transfer apps to detect patterns indicative of fraudulent activity. By identifying anomalies or suspicious behavior, the app can take proactive measures to mitigate risks, such as blocking transactions or suspending accounts. For instance, Twint, a payment app in Switzerland, utilizes AI-driven fraud detection mechanisms to safeguard users against potential threats.

- Personalized User Experiences: In a competitive landscape, personalization has emerged as a key strategy for enhancing customer engagement and retention. Generative AI enables money transfer apps to analyze user interactions and preferences, allowing them to tailor personalized offers, recommendations, and rewards. By delivering relevant content and services based on individual user behavior, apps can foster deeper connections with their user base and drive loyalty.

- AI-Powered Chatbots: Integrating AI-driven chatbots into money transfer apps offers users immediate assistance and support for various tasks. These virtual assistants can handle common inquiries, provide account information, generate reports, and offer guidance on transactions, all in real-time. By leveraging natural language processing and machine learning capabilities, AI chatbots enhance the overall user experience by providing swift and efficient customer service without the need for human intervention.

Conclusion

In conclusion, the development of money transfer apps has revolutionized the way people manage their finances, offering convenience, accessibility, and enhanced features that cater to modern consumer needs. Through careful planning, execution, and support, developers can navigate the complexities of creating these apps and deliver reliable solutions that meet user expectations.

By prioritizing user-centric design, incorporating essential features, and leveraging emerging technologies like generative AI, money transfer apps can provide seamless experiences that drive engagement, foster trust, and empower users to take control of their financial transactions. As the demand for such apps continues to grow, the opportunities for innovation and advancement in the fintech landscape are boundless, paving the way for a future where financial inclusion and empowerment are within reach for all.

If you require expert assistance in creating a mobile banking app, consider reaching out to TechnoYuga, a prominent mobile app and fintech app development company. Our team of skilled and dedicated developers is available for hire and committed to helping you achieve your business objectives. Don’t hesitate to get in touch with us at any time, as we are here to assist you around the clock.